Financing is the lifeblood that fuels growth, innovation, and stability. Whether you’re starting a new venture, expanding an existing one, or simply managing day-to-day operations, access to the right type of financing is crucial. Two common options you’ll encounter are short term loans and long term loans. In this guide, we’ll delve deep into these financing choices, explore their characteristics, and help you determine which one suits your business needs best.

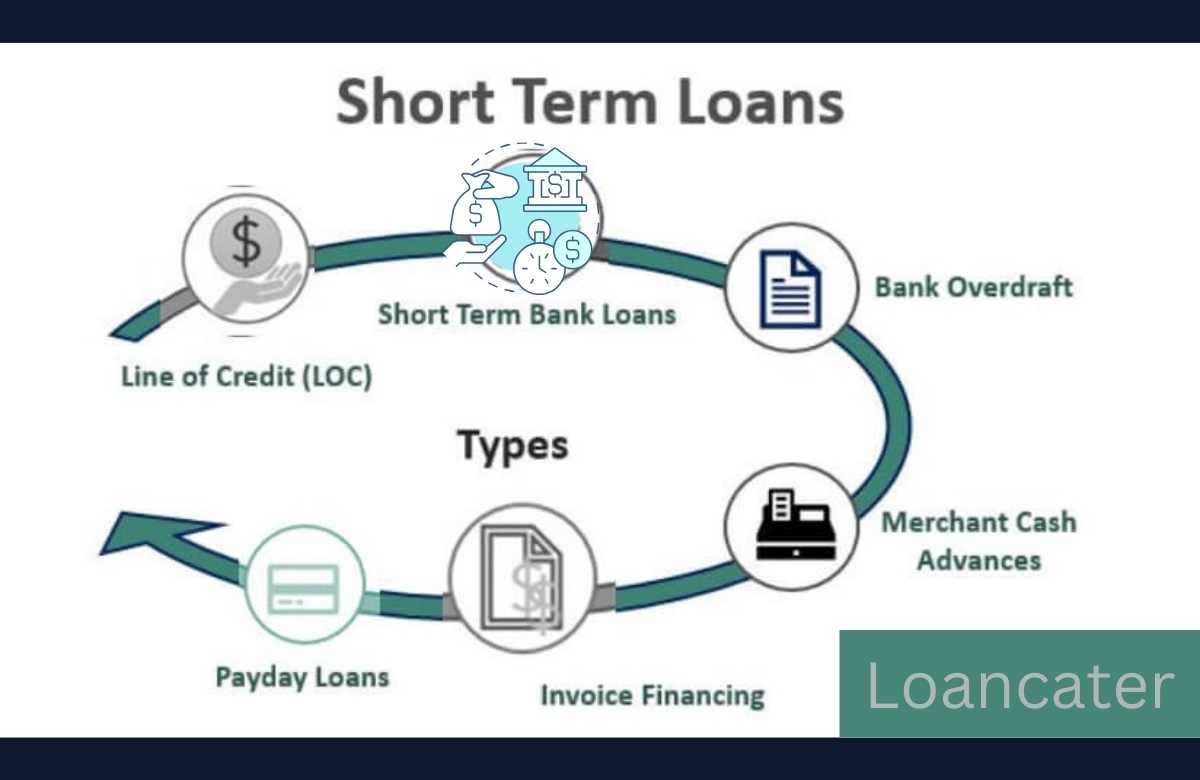

Short Term Loans

Short term loans are typically small to medium-sized loans with a repayment period ranging from a few months to a year. They are designed to address immediate financial needs and bridge cash flow gaps.

When to Consider Short Term Financing

Short term loans are ideal for covering brief, pressing financial needs. Common situations where short term loans make sense include:

- Working Capital Shortages: When your business needs quick cash to cover operational expenses.

- Seasonal Fluctuations: To manage uneven revenue during seasonal slowdowns or peaks.

- Emergency Repairs: When unexpected equipment breakdowns or repairs arise.

Pros of Short Term Loans

Quick Access to Funds: Short term loans are known for their speedy approval and funding processes. If you need cash urgently, they’re an excellent choice.

Flexibility: Borrowers often have more leeway in how they use short term loan funds. Whether it’s covering payroll, purchasing inventory, or addressing a sudden expense, short term loans offer flexibility.

Lower Total Interest: While short term loans might have higher interest rates, the shorter repayment period usually results in lower overall interest costs.

Cons of Short Term Loans

Higher Monthly Payments: Due to the shorter repayment period, monthly payments for short term loans tend to be higher than those for long term loans.

Short Repayment Period: The brevity of short term loans can be a drawback if your business needs a longer time to repay without straining cash flow.

Real-Life Scenarios: When Short Term Loans Make Sense

Scenario 1: Retail Inventory Boost Lucy owns a boutique clothing store, and she’s preparing for the holiday shopping season. She needs to stock up on inventory but is short on cash. A short term loan helps her purchase the inventory she needs to meet the increased demand during the holidays.

Scenario 2: Emergency Repairs John runs a small bakery, and his oven suddenly breaks down. Without it, he can’t bake his bestselling goods. He takes out a short term loan to get the oven repaired quickly so he doesn’t lose out on valuable sales.

Short term loans are like a financial shot in the arm. They provide quick access to cash when your business is facing immediate needs or opportunities. However, the shorter repayment period and higher monthly payments should be considered when evaluating if they are the right choice for your business.

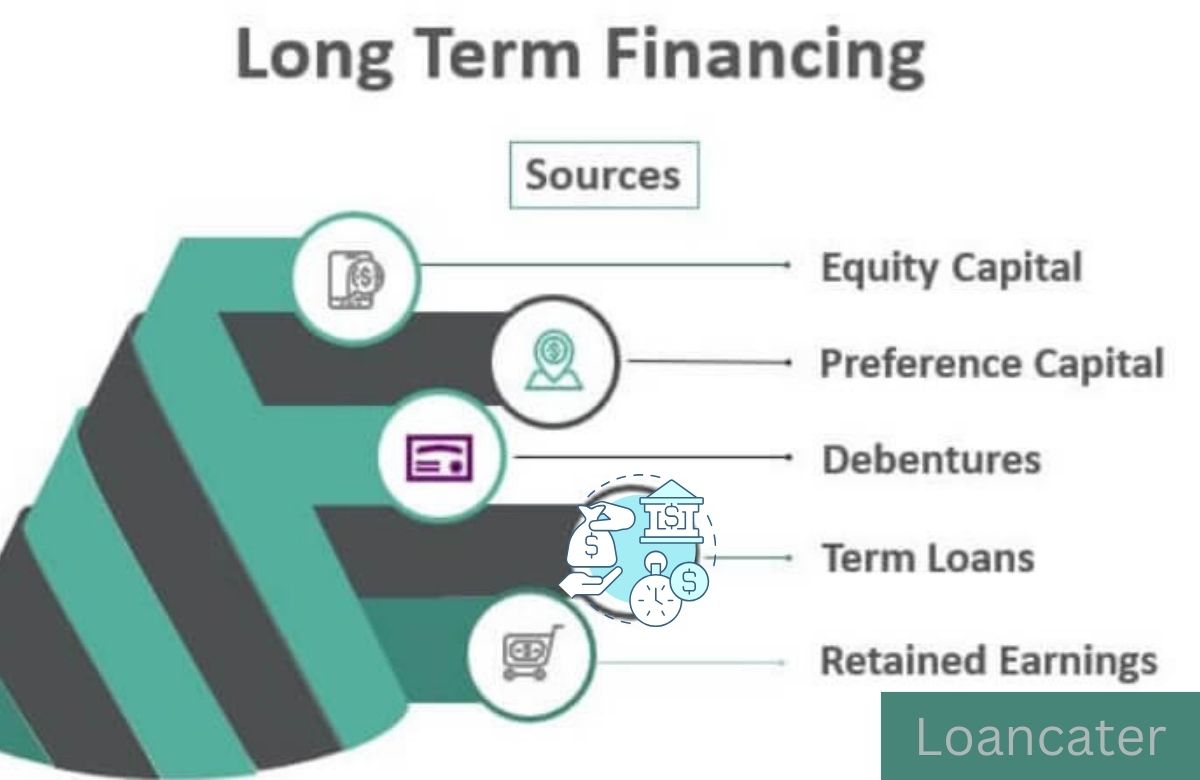

Long Term Loans

Long term loans, on the other hand, are typically larger loans with repayment periods that can extend from several years to even decades. They are designed for more substantial investments and expenses.

When Long Term Financing is Appropriate

Long term loans are suitable for:

- Major Capital Investments: Such as purchasing real estate, expanding facilities, or acquiring expensive equipment.

- Business Expansion: When you’re looking to enter new markets, scale operations, or launch a new product line.

- Debt Consolidation: Combining existing debts into a long term loan with more favorable terms.

Advantages of Long Term Loans

Lower Monthly Payments: The extended repayment period results in lower monthly payments, making it easier for businesses to manage their cash flow.

Extended Repayment Period: You have more time to repay the loan, reducing the risk of straining your finances.

Suitable for Large Investments: Long term loans are ideal when you need substantial capital for significant projects or acquisitions.

Drawbacks of Long Term Loans

Higher Total Interest: The longer repayment period means you’ll pay more in total interest compared to a short term loan.

Slower Access to Funds: Long term loans typically involve a more extensive application and approval process, which can result in a longer wait for funds.

Real-Life Examples: Situations Benefitting from Long Term Loans

Scenario 1: Real Estate Investment Mark wants to expand his manufacturing business by purchasing a larger facility. A long term loan with a lengthy repayment period allows him to invest in the new property without straining his finances.

Scenario 2: Business Expansion Sarah’s tech startup is growing rapidly, and she wants to scale her operations to meet the increasing demand for her products. A long term loan helps her hire more employees, invest in research and development, and expand her market reach.

Long term loans are like a marathon; they provide the stamina required for substantial business growth and investment. The lower monthly payments and extended repayment periods are attractive features. However, businesses should carefully consider the higher total interest costs associated with long term loans.

Choosing the Right Loan for Your Business

Selecting the right loan for your business requires a thoughtful assessment of your financial situation and business goals. Here are some essential steps to help you make an informed decision:

Assessing Your Business Needs: Determine precisely why you need the loan, whether it’s for immediate working capital, expansion, or another purpose.

Evaluating Repayment Capacity: Analyze your business’s ability to make monthly payments comfortably. This involves a detailed review of your cash flow and financial projections.

Weighing Pros and Cons: Consider the advantages and disadvantages of both short term and long term loans in the context of your specific situation.

Seeking Expert Advice: Don’t hesitate to consult with financial advisors or loan experts. They can provide valuable insights and help you make the best choice.

Comparing Interest Rates and Fees

Understanding APR: The Annual Percentage Rate (APR) provides a comprehensive view of the loan’s cost, including interest rates and fees. It’s a crucial factor when comparing loans.

Analyzing Total Interest Costs: While a loan’s interest rate is essential, the total interest you’ll pay over the life of the loan is equally significant. Be sure to calculate this figure.

Considering Origination Fees and Other Charges: Loans may come with various fees, such as origination fees or prepayment penalties. These can significantly affect the overall cost of the loan.

Credit Requirements

Impact of Credit Score on Loan Options: Your business’s credit score plays a pivotal role in the loans you qualify for and the interest rates you receive.

Minimum Credit Score for Short Term and Long Term Loans: Different lenders have varying credit score requirements. Understanding these requirements helps you target suitable lenders.

Strategies to Improve Creditworthiness: If your credit score isn’t where you’d like it to be, explore strategies to enhance your creditworthiness over time.

Application Process

Steps to Apply for Short Term Loans: The application process for short term loans is often straightforward and quick. We’ll outline the typical steps involved.

Steps to Apply for Long Term Loans: Long term loans generally require a more extensive application process. Understanding these steps can help you prepare.

Common Application Mistakes to Avoid: Knowing what to watch out for can prevent application errors that may delay or hinder loan approval.

Repayment Strategies

Creating a Repayment Plan: The importance of developing a clear and realistic repayment plan for your loan.

Automating Loan Payments: How automating your loan payments can streamline the repayment process and reduce the risk of missed payments.

Dealing with Unforeseen Financial Setbacks: Strategies for managing unexpected financial challenges while repaying your loan.

Conclusion

In the world of business finance, the choice between short term and long term loans is not one-size-fits-all. It’s a decision that should be guided by your unique business needs, financial situation, and goals. By understanding the key differences between these two financing options and carefully evaluating your circumstances, you can make an informed choice that sets your business on a path to success.

FAQs (Frequently Asked Questions)

Are short term loans easier to qualify for than long term loans?

Short term loans typically have less stringent qualification criteria than long term loans. They are often more accessible, making them suitable for businesses with varying credit profiles.

What are the typical interest rates for short term and long term loans?

Interest rates can vary widely depending on factors like the lender, your creditworthiness, and the current economic environment. Short term loans may have higher interest rates, but long term loans can accumulate more interest over time.

Can I use a long term loan to cover short term expenses?

While you can use a long term loan to cover short term expenses, it’s important to consider the long term financial implications. You’ll be committed to repaying the loan over an extended period, which may not align with the short term nature of the expenses.

How do I decide between fixed and variable interest rates?

The choice between fixed and variable interest rates depends on your risk tolerance and your outlook on interest rate movements. Fixed rates offer stability, while variable rates can be lower initially but may fluctuate with market changes.

Is it possible to switch from a short term to a long term loan or vice versa?

Depending on your lender and the terms of your loan agreement, it may be possible to refinance or modify your loan to switch between short term and long term options. However, this can involve additional fees and considerations.