In today’s financial world, it’s easy to find yourself trapped in a cycle of debt. You may have credit card debts, auto loans, student loans, and perhaps even a mortgage. Juggling all these debts can be overwhelming and jeopardize your financial stability. This is where debt consolidation comes into play.

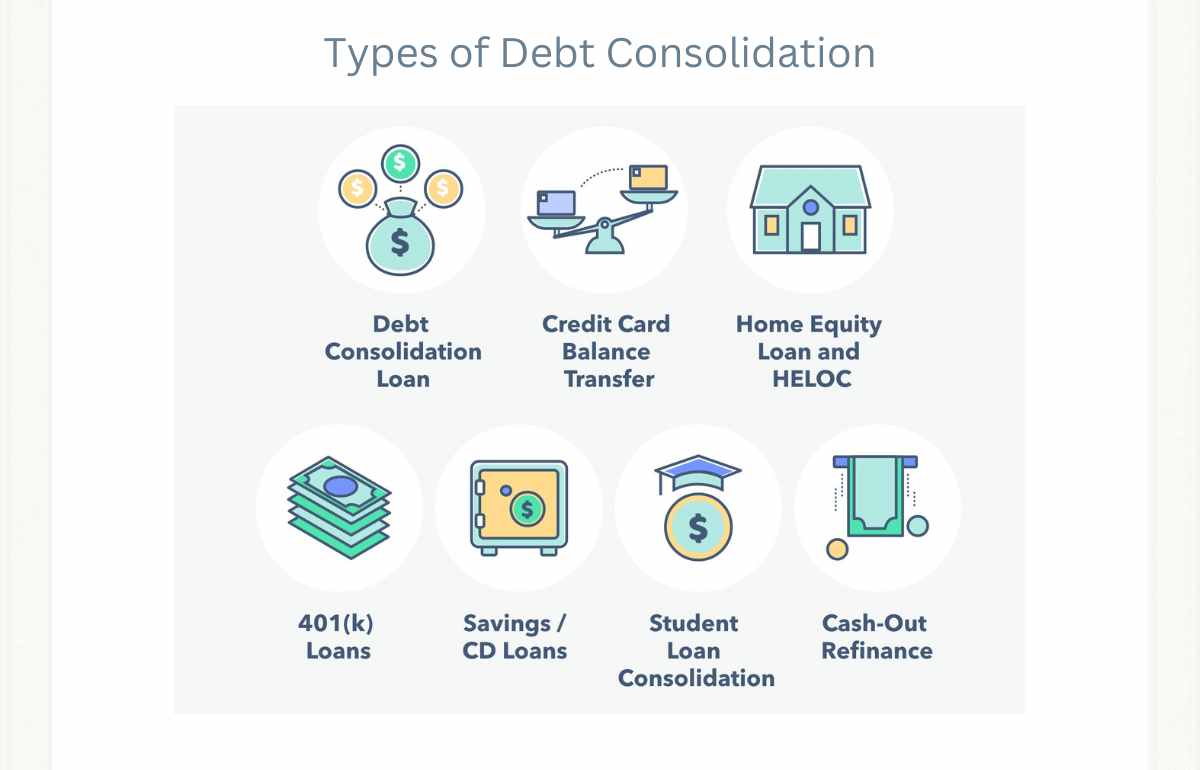

Types of Debt Consolidation

There are several methods of debt consolidation, but the most common ones include:

1. Credit Card Balance Transfer

This involves transferring your credit card debts to a card with a lower interest rate, typically with an introductory period of 0% interest.

2. Debt Consolidation Loans

You can take out a loan to consolidate your debts. This loan usually comes with a lower interest rate compared to your existing debts.

3. Home Equity Loans

If you own a home, you can use your home as collateral to secure a loan for debt consolidation. This often comes with the lowest interest rates.

How Does Debt Consolidation Work?

The concept behind debt consolidation is simple. You combine your various debts into a single debt. This allows you to repay your debts at a lower interest rate, usually over an extended period.

Benefits of Debt Consolidation

Debt consolidation offers several advantages:

- Lower Interest Rates: By combining your debts, you can benefit from lower interest rates, resulting in reduced overall costs.

- Simplified Finances: Instead of managing multiple creditors and due dates, you have only one monthly payment.

- Faster Debt Repayment: Lower interest rates enable you to pay off your debts more quickly, helping you achieve financial freedom faster.

- Improved Credit Score: Successful debt consolidation can positively impact your creditworthiness.

When Is Debt Consolidation a Good Idea?

Debt consolidation is a good idea in the following situations:

- You have high interest rates on your debts.

- You owe money to multiple creditors.

- You have a stable income.

How to Consolidate Debt

Debt consolidation involves several steps:

- Evaluate Your Debts: First, you should have a clear understanding of the total amount of your debts and who you owe.

- Choose the Right Debt Consolidation Option: Depending on your needs and financial situation, select the most suitable method.

- Create a Repayment Plan: Determine how you will pay off your debts and create a budget plan.

Risks and Considerations of Debt Consolidation

It’s essential to note that debt consolidation also carries risks. For instance, there is the potential to accumulate new debt after consolidation. Furthermore, missing monthly payments during debt consolidation can negatively impact your credit score.

Debt Consolidation vs. Bankruptcy

Debt consolidation should not be confused with bankruptcy. While debt consolidation aims to organize and reduce your debts, bankruptcy signifies that you can no longer repay your debts, leading to legal actions.

Steps to Start Debt Consolidation

If you decide on debt consolidation, follow these steps:

- Research Lenders: Find reputable lenders or financial institutions offering debt consolidation services.

- Gather Necessary Documents: Ensure you have all the required documentation ready for your debt consolidation application.

- Apply for Debt Consolidation: Complete the application and submit it along with the necessary documents.

- Review the Terms: Carefully read through the terms and conditions of the debt consolidation plan before agreeing.

Managing Debt After Consolidation

After debt consolidation, it’s crucial to create a budget and avoid accumulating new debt. Regularly monitor your progress and adjust your plan as needed.

Success Stories

Let’s explore some success stories of individuals who have successfully consolidated their debts. This can demonstrate that debt consolidation is achievable and can bring financial freedom within reach.

Conclusion

Debt consolidation is a valuable tool for improving your financial situation. Lower interest rates and better debt management can help you become debt-free more quickly. Keep in mind that while debt consolidation offers benefits, it also carries risks. Conduct thorough research and careful planning before embarking on this path.

FAQs

What is the best debt consolidation option for me?

The best option depends on your individual financial situation and goals.

Can I consolidate student loans with other debts?

Yes, student loans can be consolidated with other debts.

Will debt consolidation affect my creditworthiness?

Yes, debt consolidation can impact your credit score, especially if you miss monthly payments.

How long does the debt consolidation process take?

The duration of the process depends on various factors but can span from several months to years.

Is debt consolidation a permanent solution to debt problems?

Debt consolidation can help manage debt, but it’s not a permanent solution. It requires disciplined financial behavior for long-term success.

Now that you have a comprehensive understanding of debt consolidation and how it can impact your financial future, if you’re ready to consolidate your debts and strive for financial freedom, you can take the first step now: