In the dynamic world of construction, managing finances is a critical aspect of running a successful business. Construction companies often face unique financial challenges, from dealing with project delays to fluctuating cash flows. In such a demanding environment, it’s not uncommon for these companies to accumulate multiple debts over time. This is where debt consolidation can be a game-changer.

A Brief Overview of Debt Consolidation

Debt consolidation is a financial strategy that involves combining multiple debts into a single, more manageable loan. The primary goal is to simplify debt repayment, potentially secure a lower interest rate, and reduce the overall financial burden.

The Relevance of Debt Consolidation for Construction Companies

Construction companies, regardless of their size, frequently rely on various forms of financing to fund their operations. These financing methods can include business loans, equipment leases, and lines of credit. Over time, managing these multiple debts can become overwhelming, leading to issues such as missed payments and a strained cash flow.

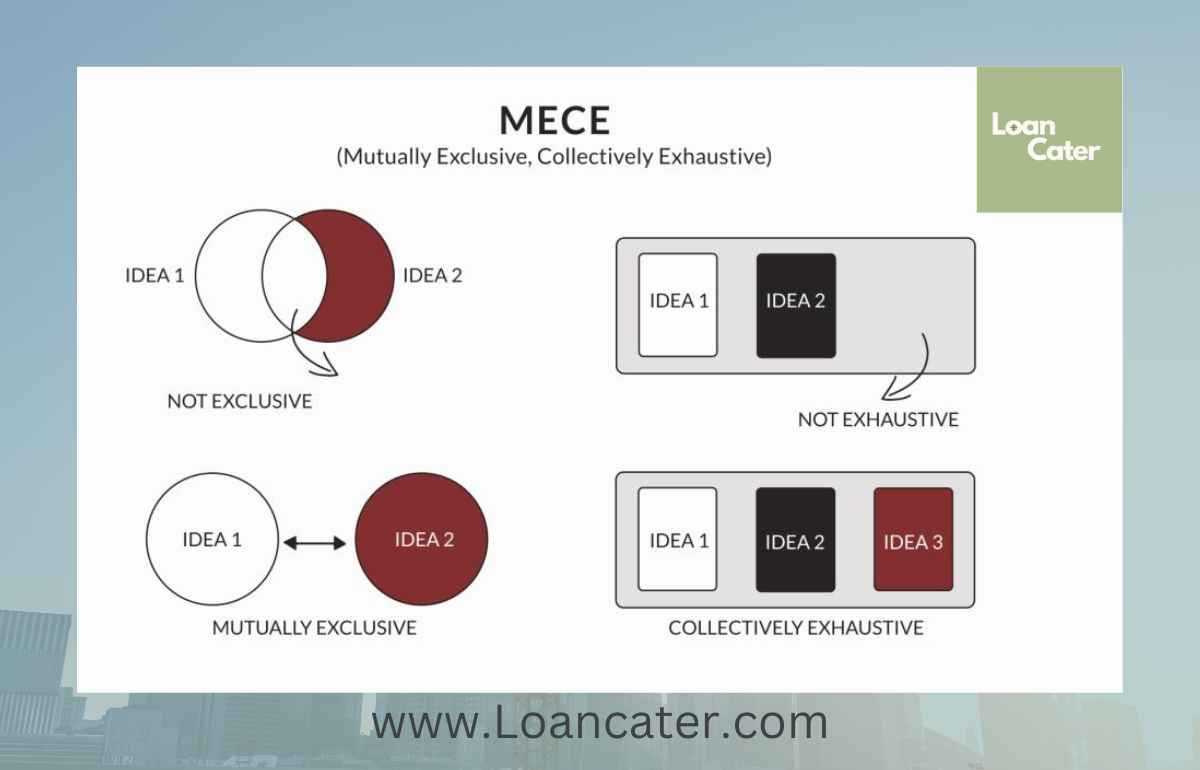

The MECE Approach to Debt Consolidation

To effectively explore debt consolidation for construction companies, we will adopt the MECE (Mutually Exclusive, Collectively Exhaustive) framework. This approach ensures that our analysis covers all essential aspects of debt consolidation.

Understanding Construction Company Debt

Types of Debt Commonly Incurred by Construction Companies

Construction companies often incur various types of debt, including:

- Business Loans: These are general-purpose loans used to cover operational expenses, purchase materials, or hire additional staff.

- Equipment Leases: Many construction firms lease heavy machinery and equipment, which can lead to equipment-related debts.

- Lines of Credit: A revolving credit line provides flexibility for covering short-term expenses and managing cash flow gaps.

The Impact of Debt on a Construction Business

Accumulated debt can have several consequences for construction companies:

- Increased financial stress

- Higher interest payments

- Reduced cash flow for essential expenses

- Difficulty in securing new financing

Signs That Your Construction Company May Benefit from Debt Consolidation

It’s essential to recognize the signs that your construction company might benefit from debt consolidation:

- Struggling to make minimum monthly payments on time.

- High-interest rates on existing loans.

- Multiple creditors and due dates need to be clarified.

- A desire to simplify financial management.

Benefits of Debt Consolidation

Streamlining Multiple Debts into One

Debt consolidation simplifies your financial life by rolling multiple debts into a single loan. This reduces the number of payments to track, making it easier to manage your finances.

Lower Interest Rates and Monthly Payments

One of the primary motivations for debt consolidation is the potential for lower interest rates. With a lower rate, you can reduce the total cost of your debt and lower your monthly payments.

Improved Cash Flow Management

Debt consolidation can lead to more predictable cash flow management. Instead of dealing with varying interest rates and due dates, you have a fixed monthly payment to budget for.

Protecting Business Credit Score

Consistently making on-time payments through a debt consolidation plan can positively impact your business credit score, which is crucial for securing future financing.

Debt Consolidation Options

Traditional Business Debt Consolidation Loans

Traditional lenders offer business debt consolidation loans, which are specifically designed for combining existing debts into one. These loans often come with competitive interest rates and repayment terms.

SBA 7(a) Loan for Debt Consolidation

The Small Business Administration (SBA) offers the 7(a) loan program, which can be used for debt consolidation purposes. These loans are partially guaranteed by the SBA, making them more accessible for businesses.

Equipment Refinancing for Debt Consolidation

If your construction company has outstanding equipment loans, consider refinancing as a debt consolidation method. Refinancing allows you to secure better loan terms, reducing your overall financial burden.

Invoice Factoring as a Debt Consolidation Strategy

For construction companies with outstanding invoices, invoice factoring can be an effective debt consolidation strategy. You sell your unpaid invoices to a factoring company, which provides immediate cash, consolidating your debts.

Personal Loans for Debt Consolidation

In some cases, business owners may use personal loans for debt consolidation. However, this option is riskier as it involves personal assets and credit.

Assessing Your Construction Company’s Financial Health

Evaluating Current Debts and Liabilities

Before proceeding with debt consolidation, assess your current debts and liabilities. Understand the total outstanding balance, interest rates, and terms of each debt.

Calculating Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a crucial metric lenders consider when assessing your eligibility for debt consolidation. A lower DTI ratio increases your chances of approval.

Identifying Your Debt Consolidation Goals

Clearly define your goals for debt consolidation. Whether it’s reducing interest costs, simplifying payments, or improving cash flow, knowing your objectives will guide your strategy.

The Debt Consolidation Process

Researching Lenders and Loan Products

Research different lenders and loan products available for debt consolidation. Compare interest rates, terms, and fees to find the most suitable option.

Preparing Necessary Documentation

Gather all required documentation for your debt consolidation application. This typically includes financial statements, loan agreements, and credit reports.

Applying for a Debt Consolidation Loan

Submit your loan application, ensuring all information is accurate and complete. Be prepared to provide additional details if requested by the lender.

Loan Approval and Disbursement

The lender will review your application, assess your creditworthiness, and determine your eligibility for a debt consolidation loan. Upon approval, the funds are disbursed to pay off your existing debts.

Managing Debt After Consolidation

Implementing Effective Debt Repayment Strategies

Create a debt repayment strategy that aligns with your financial goals. Consider strategies like the debt snowball or debt avalanche method.

Budgeting and Financial Planning

Develop a comprehensive budget and financial plan to ensure you can make consistent monthly payments on your consolidated debt.

Avoiding Accumulation of New Debts

To achieve long-term financial stability, avoid accumulating new debts while you work on repaying your consolidated loan.

Case Studies: Successful Debt Consolidation in Construction

Explore real-world examples of construction companies that successfully used debt consolidation to overcome financial challenges and achieve growth.

Risks and Considerations

Potential Pitfalls of Debt Consolidation

Debt consolidation is not without risks. It’s essential to be aware of potential pitfalls, such as extending the repayment period, which may increase the total interest paid.

Impact on Business Credit Score

While debt consolidation can positively impact your credit score, missed payments or defaulting on the new loan can have adverse effects.

Alternative Solutions to Debt Issues

Debt consolidation may not be the right solution for every construction company. Explore alternative options, such as renegotiating loan terms or seeking financial counseling.

FAQ

What is Debt Consolidation, and How Does It Work?

Debt consolidation is the process of combining multiple debts into a single loan with more favorable terms, simplifying debt repayment.

Can Startups in the Construction Industry Benefit from Debt Consolidation?

Debt consolidation is typically more suitable for established construction companies with existing debt burdens.

Will Debt Consolidation Affect My Business Credit Score?

Consistently making on-time payments on your consolidated loan can positively impact your business credit score.

Are There Tax Implications Associated with Debt Consolidation?

Debt consolidation itself usually does not have direct tax implications, but it’s advisable to consult a tax professional for guidance.

How Long Does It Typically Take to See the Benefits of Debt Consolidation?

The timeline for realizing the benefits of debt consolidation varies depending on factors like your existing debt, interest rates, and the chosen consolidation method.

Conclusion

In conclusion, debt consolidation can be a valuable financial tool for construction companies looking to streamline their finances, reduce interest costs, and improve cash flow management. By understanding the various debt consolidation options, assessing your company’s financial health, and carefully managing the consolidation process, your construction business can achieve more excellent financial stability and sustainable growth. Don’t let debt hold your construction company back; explore the possibilities of debt consolidation today.