Low Doc Business Funding

In the fast-paced world of business, access to quick and hassle-free funding can make all the difference. That’s where LoanCater comes in. We understand that traditional lending processes can be cumbersome and time-consuming, especially for small businesses. This is why we’re committed to providing a solution that unlocks opportunities for growth and success through low doc business funding.

Understanding the Need for Low Doc Business Funding

Running a business involves constant financial demands. Whether it’s to bridge a cash flow gap, invest in new equipment, or fuel expansion efforts, having access to funds when you need them is crucial. However, traditional lenders often require a mountain of paperwork, detailed financial statements, and a lengthy approval process. For many small business owners, this can be overwhelming and time-consuming.

LoanCater’s Role in Providing Hassle-Free Funding Solutions

LoanCater recognizes the challenges faced by businesses seeking quick and flexible financing. Our mission is to simplify the lending process and make funding accessible to businesses of all sizes. With our low doc business funding options, you can say goodbye to the extensive paperwork and hello to streamlined approval and swift access to funds.

The Concept of Low Doc Business Funding

Low doc business funding, as the name suggests, is a financing option that requires minimal documentation compared to traditional loans. Instead of drowning in paperwork, business owners can provide basic documents that prove their business’s stability and revenue. This streamlined approach accelerates the approval process, allowing you to focus on what matters most – growing your business.

Advantages of Low Doc Business Funding

The benefits of low doc business funding are numerous:

- Streamlined Application Process: Say goodbye to stacks of paperwork. With minimal documentation, you can complete your application quickly and efficiently.

- Faster Approval Turnaround: Traditional loan approvals can take weeks. Low doc funding often provides approval in a matter of days, if not hours.

- Reduced Documentation Requirements: No need to provide extensive financial statements. Basic documents are enough to get you started.

- Accessibility for Small Businesses: Small businesses, startups, and entrepreneurs can gain access to funds without the burden of meeting complex requirements.

Eligibility Criteria for Low Doc Business Funding

LoanCater’s low doc funding is designed to be accessible to a wide range of businesses. Eligibility is often based on factors such as your business’s stability, revenue, and time in operation. This means that even if you’re a startup or a small business with limited financial history, you can still qualify for the funding you need to thrive.

Types of Low Doc Business Funding

LoanCater offers a variety of low doc funding options to suit your business needs:

- Merchant Cash Advances: Receive funds upfront in exchange for a percentage of future credit card sales.

- Invoice Financing: Unlock funds by selling outstanding invoices, allowing you to access capital tied up in unpaid invoices.

- Business Lines of Credit: Gain access to a revolving line of credit that covers various business expenses up to a predetermined limit.

- Short-Term Business Loans: Secure funds without the need for extensive financial statements, making it an ideal solution for quick financial needs.

The Application Process

Applying for low doc business funding with LoanCater is straightforward:

- Fill Out the Application: Provide basic information about your business, funding needs, and intended use of funds.

- Provide Basic Documentation: Submit essential documents that showcase your business’s stability and revenue.

- LoanCater’s Online Application Platform: Our user-friendly online platform makes applying for funding a breeze.

Benefits of LoanCater’s Low Doc Funding

When you choose LoanCater, you’re choosing a partner dedicated to your business’s success:

- Personalized Funding Solutions: We understand that every business is unique. Our funding solutions are tailored to meet your specific needs.

- Transparent Terms and Conditions: There are no hidden surprises. We provide clear and concise terms, so you know exactly what you’re getting.

- Expert Assistance Throughout the Process: Our experienced team is here to guide you through the application process and answer any questions you may have.

Common Use Cases for Low Doc Funding

Low doc business funding can be used to cover a wide range of business expenses, including:

- Managing Cash Flow Gaps: Ensure a steady cash flow during slower periods or unexpected expenses.

- Funding Equipment Purchases: Upgrade or acquire new equipment to enhance your business operations.

- Supporting Marketing and Expansion: Invest in marketing efforts or expand your business to reach new heights.

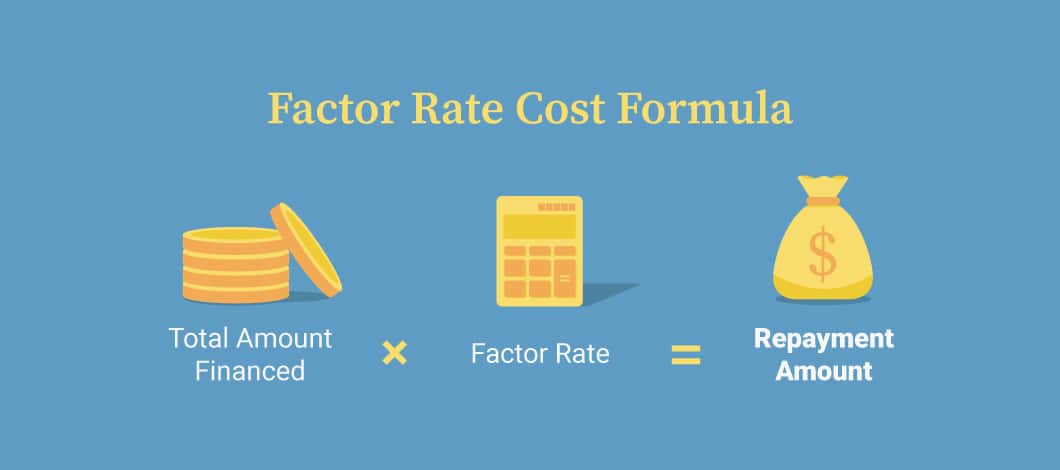

Understanding Interest Rates and Repayment

Interest rates for low doc funding may be slightly higher compared to traditional loans. However, the benefits of quick access to funds often outweigh the slightly higher cost. Repayment terms are flexible and can be tailored to match your business’s cash flow.

Comparing Low Doc Funding to Traditional Loans

Low doc funding offers several advantages over traditional loans:

- Speed of Approval: Low doc funding approvals are significantly faster, helping you seize opportunities without delays.

- Documentation Requirements: Skip the extensive paperwork and provide only essential documents.

- Repayment Terms: Flexible repayment terms ensure that your business’s financial health is considered.

FAQs about Low Doc Business Funding

- What is low doc business funding?

-

- Low doc business funding offers quick access to funds with minimal documentation requirements.

- How fast can I expect to receive funds?

-

- In many cases, you can receive funding in as little as 24 hours.

- Is my credit score a deciding factor?

-

- While credit scores may be considered, other factors such as business revenue and stability are equally important.

- Can startups apply for low doc funding?

-

- Yes, startups and small businesses can benefit from low doc funding options.

- What if I need more funding later on?

- LoanCater offers multiple funding options, so you can secure additional funds when needed.

Conclusion

Low doc business funding at LoanCater opens doors to quick, flexible, and hassle-free financing. Whether you’re a startup or an established business, our tailored solutions empower you to take your business to new heights. Say goodbye to paperwork and hello to opportunities with LoanCater by your side. Contact us today to explore how low doc funding can fuel your business’s growth and success.