In a financial world where credit scores often dictate access to loans and credit, individuals with less-than-perfect credit histories can face significant hurdles when seeking financial assistance. However, the landscape is not without hope. This comprehensive guide is designed to shed light on the various loan options available for individuals with bad credit in the USA, empowering them to make informed decisions and take control of their financial future.

Understanding the Challenge of Bad Credit

Having a poor credit score can arise from a myriad of factors, including missed payments, high credit utilization, or even past financial difficulties. A low credit score often translates to higher risk in the eyes of traditional lenders, making loan approval a daunting task. But fret not, as specialized options exist to help bridge the financial gap.

The Importance of Credit Scores

Credit scores wield immense power in the realm of personal finance. Lenders rely on this three-digit number to gauge an individual’s creditworthiness and their potential risk as a borrower. A lower credit score typically translates to higher lending risk, leading to potential loan denials or loans with less favorable terms. Understanding the significance of credit scores is fundamental as we delve into the realm of bad credit loans.

Types of Loans Available for Bad Credit

Secured vs. Unsecured Loans

One’s credit score often dictates the type of loan they can secure. Secured loans require collateral, such as a car or property, to secure the loan. Unsecured loans, however, don’t necessitate collateral but often come with higher interest rates to compensate for the heightened lending risk.

Personal Installment Loans

These loans provide borrowers with a lump sum of money, which is then repaid in fixed monthly installments. These loans can be tailored to various purposes, from debt consolidation to unforeseen expenses.

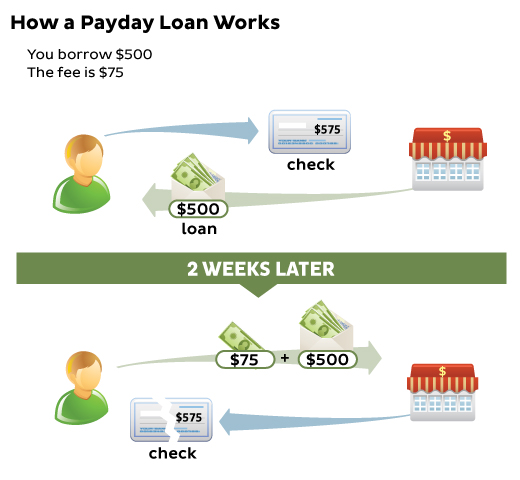

Payday Loans

Payday loans offer quick access to cash, but the convenience comes at a cost. These loans often carry high-interest rates and short repayment periods, which can lead to a cycle of debt if not managed responsibly.

Title Loans

Title loans involve using your vehicle’s title as collateral. While they offer speedy access to funds, they often come with short repayment terms and elevated interest rates.

Peer-to-Peer (P2P) Loans

P2P lending platforms connect borrowers directly with individual lenders. While they offer more flexibility than traditional lenders, interest rates can still be substantial for individuals with bad credit.

Exploring Bad Credit Loan Lenders

Traditional Banks

Traditional banks often have stringent credit requirements, making loan approval challenging for individuals with bad credit. However, if you have an established relationship with a bank, they may offer more favorable terms.

Online Lenders

Online lenders have gained popularity for their accessibility and convenience. They often consider a broader range of factors beyond credit scores when evaluating loan applications.

Credit Unions

Credit unions, member-owned financial institutions, are known for their personalized service and potential willingness to work with individuals with bad credit.

Alternative Lenders

Alternative lenders specialize in serving borrowers with less-than-ideal credit scores. However, the terms and conditions of these loans can vary significantly, necessitating thorough research and comparison.

Factors to Consider Before Applying

Loan Interest Rates and Terms

Interest rates can significantly impact the total cost of your loan. Individuals with bad credit often face higher interest rates, so understanding the rates and terms is crucial.

Loan Amounts and Repayment Period

The loan amount and the duration of the repayment period can directly impact your monthly obligations. Ensure you’re comfortable with both before proceeding.

Additional Fees and Charges

Hidden fees and charges can inflate the cost of your loan. Always review the fine print and inquire about any potential additional costs.

Improving Your Chances of Approval

Building a Positive Payment History

Consistently making on-time payments on existing debts can gradually improve your credit score over time.

Debt Consolidation and Management

Consolidating high-interest debts can simplify your financial obligations and positively impact your credit utilization ratio.

Co-signers and Collateral

Enlisting a co-signer with strong credit or offering collateral can increase your chances of loan approval.

The Loan Application Process

Gathering Required Documentation

Prepare the necessary documentation, including proof of income and identification, to streamline the application process.

Online vs. In-Person Applications

Online applications offer convenience, while in-person applications provide an opportunity for face-to-face interaction.

Pre-Approval and Loan Offers

Pre-approval can provide insight into your eligibility and potential loan terms before committing to a specific lender.

Responsible Borrowing and Financial Planning

Creating a Budget

Develop a comprehensive budget to ensure you can comfortably meet your loan repayment obligations.

Avoiding Predatory Lending

Be cautious of predatory lending practices that target individuals with bad credit, such as payday loans with exorbitant interest rates.

Repayment Strategies

Explore various repayment strategies to ensure you’re on track to fulfill your loan obligations.

Benefits and Risks of Bad Credit Loans

Access to Funds During Emergencies

Bad credit loans can provide quick access to funds during unexpected financial emergencies.

Rebuilding Credit vs. High-Interest Rates

While bad credit loans can help bridge financial gaps, they often come with higher interest rates. Consider the trade-offs between immediate needs and long-term financial goals.

Pros and Cons of Each Loan Type

When it comes to securing a loan with bad credit, it’s essential to carefully weigh the pros and cons of each loan type to make an informed decision that aligns with your financial goals and circumstances. Here, we delve into the advantages and disadvantages of the various loan options available for individuals with less-than-perfect credit:

Personal Installment Loans

Pros:

- Predictable Repayment: Fixed monthly payments make budgeting and planning easier.

- Flexible Use: Funds can be used for a wide range of purposes, from debt consolidation to home repairs.

- Potential for Credit Improvement: Timely payments can contribute to rebuilding your credit over time.

Cons:

- Interest Rates: Rates may be higher due to the perceived risk of lending to individuals with bad credit.

- Eligibility Criteria: Some lenders may have strict credit requirements for approval.

Payday Loans

Pros:

- Quick Access to Cash: Payday loans offer rapid approval and funding, ideal for emergencies.

- No Credit Check: Approval is often based on income and employment, not credit history.

- Minimal Documentation: The application process is relatively straightforward.

Cons:

- Short Repayment Period: Repayment is typically due on your next payday, which may lead to a cycle of debt.

- Predatory Practices: Some lenders may engage in predatory practices, trapping borrowers in debt.

Title Loans

Pros:

- Fast Approval: Title loans provide quick access to funds based on the value of your vehicle.

- No Credit Check: Approval is primarily based on the vehicle’s value and your ability to repay.

- Continued Vehicle Use: You can keep driving your vehicle while repaying the loan.

Cons:

- High Risk: Defaulting on the loan could result in the loss of your vehicle.

- Short Repayment Period: Title loans often require repayment within a month, leading to potential financial strain.

Peer-to-Peer (P2P) Loans

Pros:

- Flexible Terms: P2P lenders offer more flexible terms and may consider factors beyond credit scores.

- Competitive Rates: Interest rates may be more favorable compared to other bad credit loan options.

- Online Convenience: The application process can be completed online, providing convenience.

Cons:

- Limited Borrowing Amounts: P2P loans may have borrowing limits, limiting the funds you can access.

- Approval Not Guaranteed: While P2P lenders may consider various factors, approval is not guaranteed for individuals with very poor credit.

Traditional Banks

Pros:

- Established Institutions: Traditional banks offer a sense of security and familiarity.

- Potential for Relationship Building: Existing bank customers may receive preferential treatment.

- Wide Range of Services: Banks offer various financial services beyond loans.

Cons:

- Stringent Requirements: Banks often have strict credit score criteria for loan approval.

- Longer Approval Process: The application and approval process at banks may be more time-consuming.

- Limited Flexibility: Banks may have less flexibility in terms of loan terms for individuals with bad credit.

Online Lenders

Pros:

- Accessible: Online lenders provide convenience and easy access to a variety of loan options.

- Speedy Process: Online applications are often quick and efficient, with rapid approval and funding.

- Variety of Options: Online platforms offer a wide range of loan types and terms.

Cons:

- Scams and Predatory Lenders: Due diligence is required to avoid scams or unscrupulous online lenders.

Credit Unions

Pros:

- Personalized Service: Credit unions prioritize member satisfaction and personalized assistance.

- Lower Fees: Credit unions may offer lower fees compared to traditional banks.

- Potential for Relationship Building: Membership in a credit union can lead to improved loan terms.

Cons:

- Membership Requirements: Credit unions have membership eligibility criteria that must be met.

- Limited Accessibility: Credit unions may have fewer physical locations compared to larger banks.

Alternative Lenders

Pros:

- Specialized Offerings: Alternative lenders cater to individuals with bad credit, offering tailored solutions.

- Fast Approval: Approval from alternative lenders may be quicker compared to traditional banks.

- Flexible Eligibility: Alternative lenders consider a broader range of factors beyond credit scores.

Cons:

- Higher Interest Rates: Interest rates from alternative lenders may still be relatively high.

- Varying Terms: Loan terms can vary significantly among alternative lenders, requiring careful comparison.

Conclusion: Empowering Financial Recovery Through Bad Credit Loans

While bad credit may present challenges, it doesn’t have to be an insurmountable barrier to obtaining the financial assistance you need. By understanding the range of bad credit loan options, practicing responsible borrowing, and taking steps to improve your credit over time, you can navigate the path toward financial stability and greater control over your economic future.