In the pursuit of financial relief and freedom, many individuals turn to debt settlement companies as a beacon of hope. These companies often make grand promises and guarantees, enticing people with the allure of quick debt resolution and reduced payments. However, beneath the surface lies a harsh reality – many debt settlement companies fail to deliver on their enticing assurances, leaving individuals in a deeper financial quagmire. In this comprehensive article, we will delve into the reasons behind the frequent failure of debt settlement companies to fulfill their commitments, shed light on the hidden pitfalls, and offer insights into safer alternatives for debt relief.

The Alluring Sales Pitches: Setting Unrealistic Expectations

1. Misleading Statistics: “Thousands of Dollars Saved!”

Many debt settlement companies boast impressive statistics, claiming to have saved thousands of dollars for numerous clients. Such statistics create a sense of trust and confidence among potential customers, leading them to believe that they too can experience similar debt relief. However, these numbers may not reflect the actual outcomes for most clients and could be misleading.

2. Quick and Hassle-Free Debt Relief

The promise of quick and hassle-free debt relief is another captivating aspect of the sales pitch. Debt settlement companies may assure clients that their financial burdens can be resolved rapidly, allowing them to move on with their lives. Unfortunately, the reality is often far from this claim, as debt settlement can be a lengthy and complicated process.

The Trap of Empty Guarantees: Deceptive Practices

3. “Pay Pennies on the Dollar”: The Risky Path

The temptation to settle debts for significantly less than what is owed can be alluring. Debt settlement companies may entice clients with the prospect of paying “pennies on the dollar” to clear their debts. However, creditors are not always willing to negotiate for lesser amounts, and missing payments during the settlement process can lead to severe consequences.

4. Promises of Legal Protection: The Grey Area

Debt settlement companies may suggest that they have special legal protections that enable them to negotiate better terms with creditors. In reality, many states have regulations in place to protect consumers from deceptive practices. Clients may unknowingly enter into legal grey areas, putting themselves at risk.

Hidden Costs and Fees: Adding to the Burden

5. Upfront Charges and Maintenance Fees

In their pursuit of debt relief, clients often overlook the hidden costs and fees associated with debt settlement services. Debt settlement companies may charge upfront fees for enrolling in their programs and ongoing maintenance fees. These additional expenses can exacerbate the financial burden rather than alleviate it.

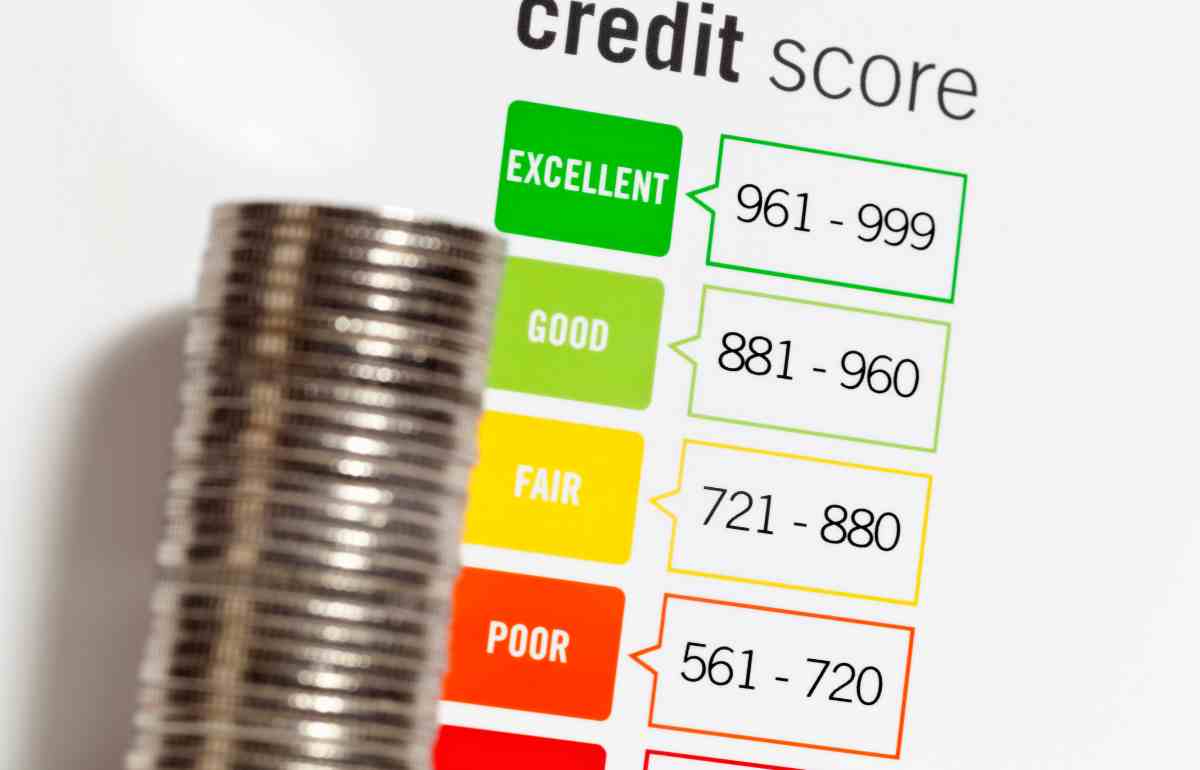

The Impact on Credit Scores: A Long-Term Consequence

6. Credit Score Damage: Missed Payments and Collections

As clients enroll in debt settlement programs, they may be advised to stop making payments to creditors and instead channel funds into a dedicated settlement account. This can lead to missed payments and collections, resulting in significant damage to credit scores. The temporary relief promised by debt settlement companies often comes at the cost of long-term credit consequences.

A Safer Path to Financial Freedom: Exploring Alternatives

7. Credit Counseling and Financial Education

For individuals seeking genuine debt relief without the risks associated with debt settlement companies, credit counseling, and financial education offer safer alternatives. These services provide structured approaches to managing debts and offer personalized guidance on budgeting and financial planning.

Conclusion

While debt settlement companies may paint a promising picture of quick and easy debt relief, their empty guarantees often lead to more financial hardship for their clients. Misleading statistics, unrealistic expectations, hidden costs, and potential legal risks create a risky landscape for those seeking debt resolution. To achieve genuine financial stability, individuals must exercise caution, explore alternatives like credit counseling, and prioritize financial education and budgeting.

Remember, the journey to financial freedom is about making informed decisions and building a solid foundation for a brighter future.

Frequently Asked Questions (FAQs)

Q: Can debt settlement companies really save thousands of dollars for clients?

A: While they may claim to do so, the actual outcomes can vary significantly, and some clients may not experience substantial savings.

Q: Is debt settlement a quick process?

A: Debt settlement can be a lengthy and complex process, contrary to the quick relief often promised.

Q: Are there legal protections that debt settlement companies can offer?

A: Some companies may suggest they have special legal protections, but consumers should be cautious about entering legal grey areas.

Q: Can debt settlement lead to credit score damage?

A: Yes, missing payments and facing collections during the settlement process can harm credit scores.

Q: Are there safer alternatives to debt settlement?

A: Yes, credit counseling and financial education provide safer paths to debt relief and financial stability.

Q: How can individuals make informed decisions about debt relief options?

A: Researching and understanding the risks and benefits of different options, along with seeking professional advice, can help individuals make informed decisions.