In the dynamic world of construction, financial stability is paramount. Every successful construction project relies on a delicate balance between funding and expenses. Managing cash flow efficiently can mean the difference between project success and failure. This is where factoring comes into play.

Understanding Factoring

What is Factoring?

Factoring is a financial tool that allows businesses to convert their accounts receivable into immediate cash. In essence, it’s a method of selling unpaid invoices to a third-party company, known as a “factor.” The factor then collects the outstanding payments from your clients.

How Factoring Works

- Application: You submit your invoices to the factor, detailing the services or products provided.

- Verification: The factor assesses the creditworthiness of your clients, as they will be responsible for repayment.

- Advance: The factor advances you a significant portion of the invoice amount, typically 70-90%.

- Collection: The factor collects the invoice payment from your client.

- Remaining Payment: Once the client pays the full invoice, the factor forwards you the remaining balance, minus their fees.

Types of Factoring in Construction

- Recourse Factoring: You’re responsible if your client doesn’t pay. This type is more common but riskier.

- Non-Recourse Factoring: The factor assumes the risk of non-payment, but fees are usually higher.

Why Factoring for Construction?

Cash Flow Management

Construction projects often involve substantial upfront costs for labor and materials. Factoring provides immediate cash, enabling you to meet these expenses without delays.

Quick Access to Funds

Unlike traditional loans, factoring offers rapid access to funds. The application process is usually quicker and less stringent.

Overcoming Seasonal Fluctuations

Many construction businesses face seasonal fluctuations. Factoring can help bridge cash flow gaps during slow seasons.

Handling Unforeseen Expenses

Construction projects are notorious for unexpected costs. Factoring provides financial flexibility to tackle these surprises head-on.

Benefits of Factoring

Improved Liquidity

Factoring increases your liquidity, ensuring you always have cash on hand for operational needs.

Debt Reduction

As factoring isn’t a loan, it doesn’t add to your debt load, contributing to a healthier financial statement.

Enhanced Financial Stability

Steady cash flow through factoring promotes financial stability, positioning your business for growth.

Focus on Core Operations

By outsourcing credit management and collections to the factor, you can concentrate on your core construction operations.

When to Consider Factoring

Emerging Construction Businesses

Factoring can be especially beneficial for new construction businesses looking to establish a solid financial foundation.

Rapid Expansion Phases

During periods of rapid growth, factoring ensures you have the necessary working capital to support your expansion.

Managing Cash Flow Gaps

If your business regularly encounters cash flow gaps between completing a project and receiving payment, factoring can be a strategic solution.

Dealing with Slow-Paying Clients

Factoring can alleviate the frustration of waiting for clients with lengthy payment terms.

The Factoring Process

Application and Documentation

You’ll provide the factor with your invoices and relevant documentation.

Due Diligence by the Factor

The factor evaluates your clients’ creditworthiness.

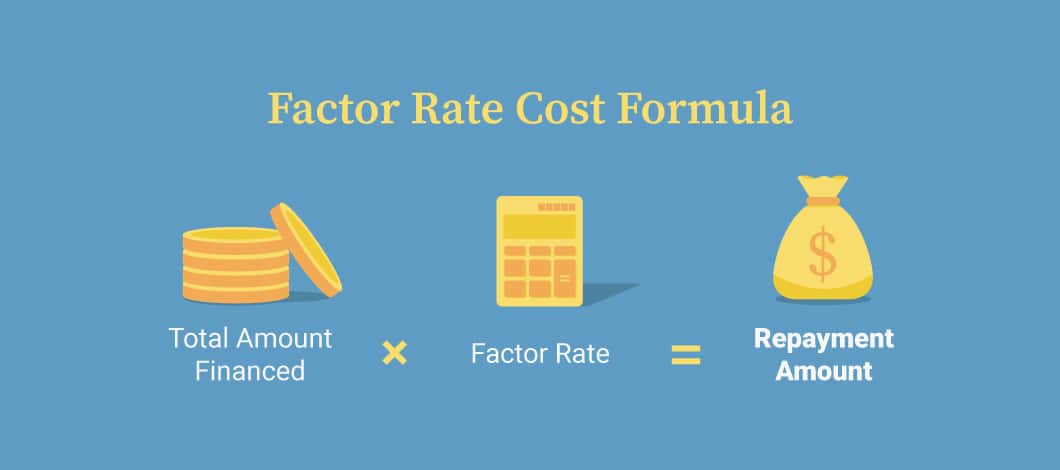

Advance Rates and Fees

You’ll receive an advance, usually 70-90% of the invoice value, minus the factor’s fees.

Funding and Collections

The factor collects the payments from your clients and disburses the remaining balance to you, minus their fees.

Selecting the Right Factor

Factors to Consider

- Industry expertise

- Reputation

- Fees and terms

- Customer service

Evaluating Factor Reputation

Research potential factors and read client reviews to ensure you’re partnering with a reputable organization.

Understanding Agreement Terms

Review the contract carefully, understanding all terms and conditions before signing.

Common Myths and Misconceptions

Factoring is a Loan

Factoring is not a loan; it’s a financial transaction based on your accounts receivable.

It’s Only for Troubled Businesses

Factoring is used by both struggling and successful businesses as a strategic financial tool.

Factoring is Expensive

While factoring comes with fees, it can often be more cost-effective than other financing options.

Challenges and Pitfalls

Hidden Costs

Factoring fees can add up, impacting your bottom line.

Client Relationships

Some clients may not appreciate invoices being handled by a third party.

Potential Legal Issues

If not managed correctly, factoring relationships can lead to disputes.

Case Studies

Real-Life Examples of Successful Factoring

Explore how other construction businesses have leveraged factoring to their advantage.

Impact on Construction Businesses

Learn how factoring can transform your construction business, boosting cash flow and fueling growth.

Factoring FAQs

How Does Factoring Affect My Clients?

Your clients are informed of the factoring arrangement, and the factor handles invoicing and collections professionally.

What if My Clients Have Bad Credit?

Factoring companies typically assess your clients’ creditworthiness and accept some level of risk.

Can I Selectively Factor Invoices?

In many cases, you can choose which invoices to factor, providing flexibility.

How Does Factoring Impact My Financial Statements?

Factoring may not significantly impact your financial statements, as it’s not a loan.