In the dynamic world of construction, general contractors play a pivotal role in bringing architectural visions to life. However, the path to success is often paved with financial challenges. This is where construction loans come into play. These specialized loans are designed to provide the necessary capital to complete projects, fuel growth, and empower general contractors to take on more significant and more ambitious undertakings. In this comprehensive guide, we’ll explore the nuances of construction loans, their advantages, the application process, and how they can be a game-changer for general contractors in the USA.

Types of Construction Loans

1. Short-Term Construction Loans

Short-term construction loans are ideal for projects with a relatively brief duration. These loans provide quick access to funds for expenses like materials, labor, and permits. They are particularly beneficial for projects with tight deadlines, allowing contractors to maintain momentum without cash flow interruptions.

2. Long-Term Construction Loans

For larger-scale projects that require extended timelines, long-term construction loans offer the flexibility to manage costs over an extended period. These loans are typically used for projects like multi-unit residential buildings or commercial complexes, where construction phases may span several years.

3. Acquisition and Development Loans

Acquisition and development loans are tailored for contractors involved in purchasing land or real estate for future construction projects. These loans cover the costs associated with acquiring property and obtaining necessary permits, making them essential for contractors looking to expand their portfolios.

Advantages of Construction Loans

The benefits of construction loans for general contractors are multifaceted:

- Capital Injection: Construction loans provide the essential capital required to initiate and complete projects, enabling contractors to secure necessary materials, equipment, and labor.

- Flexibility: These loans are customizable to the unique needs of each project, offering tailored repayment terms and interest rates.

- Growth Opportunities: With sufficient funding, contractors can take on larger and more ambitious projects, expanding their business and reputation.

- Cash Flow Management: Construction loans alleviate the strain on cash flow by providing access to funds as needed, ensuring that contractors can cover costs without delays.

- Enhanced Efficiency: By having a dedicated source of funds, contractors can streamline project execution, meet deadlines, and deliver high-quality results.

Eligibility Criteria

While eligibility criteria may vary between lenders, general contractors typically need to meet the following requirements:

- Industry Experience: Demonstrable experience in managing construction projects.

- Financial Stability: Solid financial track record and the ability to manage debt.

- Project Details: A clear and comprehensive project plan, including timelines, costs, and expected outcomes.

- Collateral: Providing collateral, such as real estate or equipment, to secure the loan.

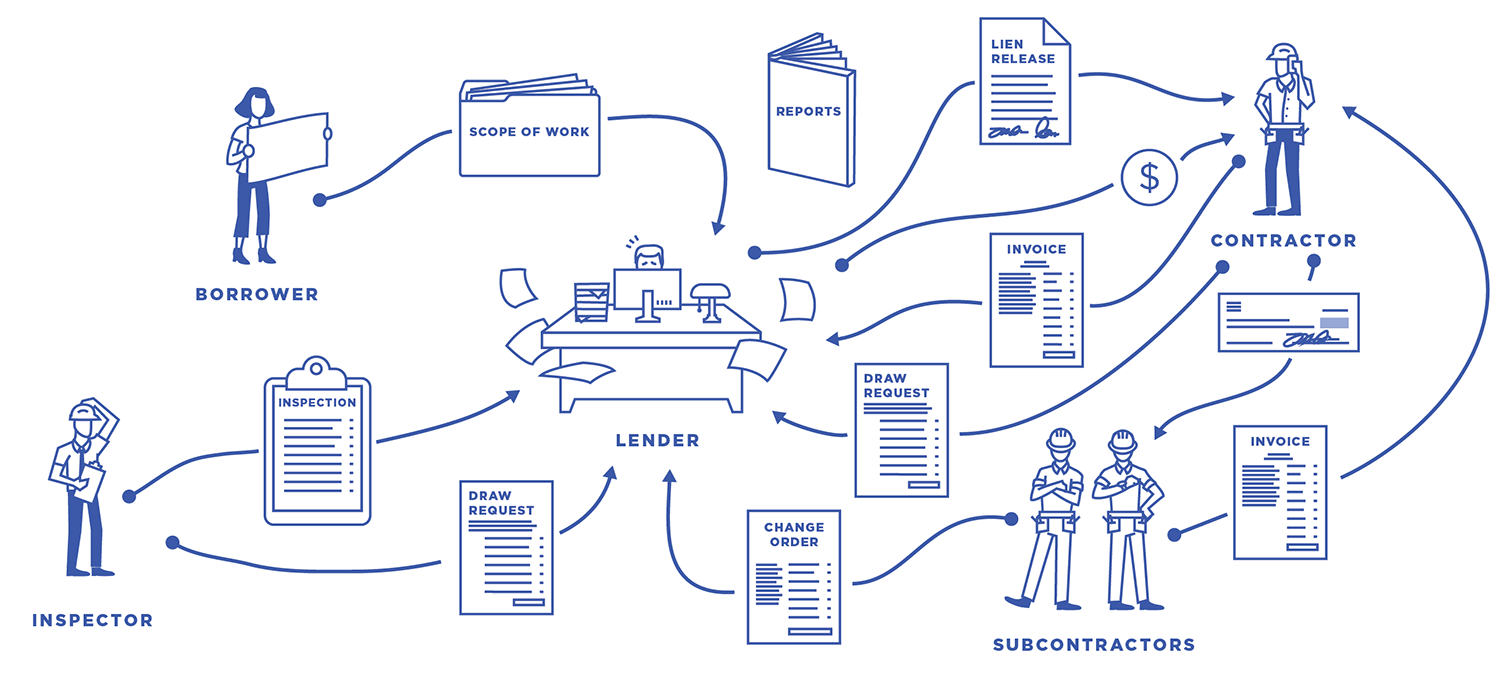

Documentation and Application

The application process for construction loans involves gathering specific documentation, such as:

- Project Plans: Detailed architectural and engineering plans.

- Budget Estimates: Comprehensive breakdown of project costs.

- Financial Statements: Up-to-date financial records of your contracting business.

- Credit History: A credit report reflecting your financial credibility.

Once the documentation is in order, the application process typically includes a thorough review of your project and financials by the lender.

Selecting the Right Lender

Choosing the right lender is crucial to securing favorable terms for your construction loan. While traditional banks offer construction loans, online lenders and specialized financial institutions have also emerged as viable options. It’s essential to consider factors such as interest rates, repayment terms, and the lender’s reputation before making a decision.

Application Review and Approval

Lenders will evaluate your application based on factors such as your creditworthiness, project feasibility, and financial stability. The approval process may involve site visits, discussions about project details, and a comprehensive assessment of your business’s ability to manage the loan.

Optimal Utilization of Funds

Once your construction loan is approved, strategic fund allocation becomes crucial. Distributing funds efficiently across project phases ensures seamless progress. This includes covering initial expenses, ongoing costs, and any unforeseen circumstances that may arise during construction.

Budget Management

Effective budget management is essential to ensure that your construction project remains on track financially. Regularly monitoring expenses, tracking variances, and adjusting your budget as needed will help prevent cost overruns and delays.

Compliance and Regulations

Navigating regulatory requirements and compliance standards is a fundamental aspect of any construction project. Adhering to local laws, permits, and safety regulations is not only a legal obligation but also ensures the successful completion of your project without unexpected setbacks.

Project Delay Management

Delays in construction projects can be detrimental to both the timeline and budget. Having contingency plans in place to manage unexpected delays, such as adverse weather conditions or supply chain disruptions, can help mitigate potential risks.

Risk Mitigation Strategies

Proactively identifying and addressing potential risks is a hallmark of successful construction projects. Risk mitigation strategies for blacklisted business owners, involve anticipating challenges and having strategies in place to address them effectively.

Return on Investment (ROI)

Construction loans, when used effectively, have the potential to yield substantial returns on investment. Contractors can leverage the funds to take on larger projects, complete them efficiently, and establish a reputation for delivering high-quality work.

Case Studies

Exploring real-life case studies of general contractors who have successfully utilized construction loans to expand their businesses, enhance efficiency, and achieve remarkable results.

Efficiency Enhancements

Construction loans can also be used to invest in technology, equipment, and training that enhance overall project efficiency and quality.

Repayment Strategies

Developing a robust repayment strategy is crucial to ensuring that you meet your loan obligations. Aligning your repayment schedule with project milestones and expected revenue can help manage the financial aspect of your construction project effectively.

Lender Relationships

Building and maintaining positive relationships with lenders can have long-term benefits for your contracting business. Establishing trust and reliability can open doors to future funding opportunities for upcoming projects.

Market Challenges

Navigating market challenges, such as economic fluctuations and industry trends, requires a combination of foresight and adaptability. Staying informed about market dynamics and adjusting your strategies accordingly can help you weather uncertainties successfully.

Conclusion

Construction loans for general contractors in the USA offer a pathway to growth, innovation, and success. By understanding the intricacies of these loans, conducting thorough research, and approaching the application process strategically, contractors can secure the funding needed to bring their projects to life and build a prosperous future in the construction industry.

FAQs

Can construction loans cover both residential and commercial projects?

Construction loans can be used for a wide range of projects, including both residential and commercial endeavors. Whether you’re building a single-family home or a large-scale commercial complex, construction loans can provide the necessary funding to bring your vision to life.

What role does credit history play in securing a construction loan?

Credit history plays a significant role in securing a construction loan. Lenders assess your creditworthiness to determine the risk of lending to you. A strong credit history can lead to more favorable loan terms and interest rates, while a lower credit score might require additional collateral or higher interest rates.

Is it possible to obtain multiple construction loans simultaneously?

While it’s possible to have multiple construction loans at the same time, lenders will carefully evaluate your ability to manage multiple projects and debt obligations. Each loan application will undergo scrutiny to ensure your financial stability and capacity to handle multiple projects effectively.

How do construction loans differ from traditional business loans?

Construction loans differ from traditional business loans in terms of purpose and structure. Construction loans are tailored for funding specific building projects and are often disbursed in phases as the project progresses. Traditional business loans, on the other hand, provide general working capital for ongoing business operations.

What happens if unforeseen circumstances cause project delays and budget overruns?

Unforeseen circumstances, such as weather disruptions or supply chain issues, can impact project timelines and budgets. In such cases, communication with your lender is vital. Some lenders offer flexibility in adjusting loan terms to accommodate delays, while contingency planning and effective risk management can help mitigate the impact of these challenges.