In the world of business, having the right tools can make all the difference. For many industries, heavy equipment is the backbone that drives productivity, efficiency, and ultimately, growth. However, acquiring heavy equipment can be a substantial financial undertaking that leaves small business owners grappling with the challenge of balancing their budget while investing in the tools they need. This is where heavy equipment financing steps in, offering a strategic solution that empowers businesses to access the equipment they require without compromising their financial stability.

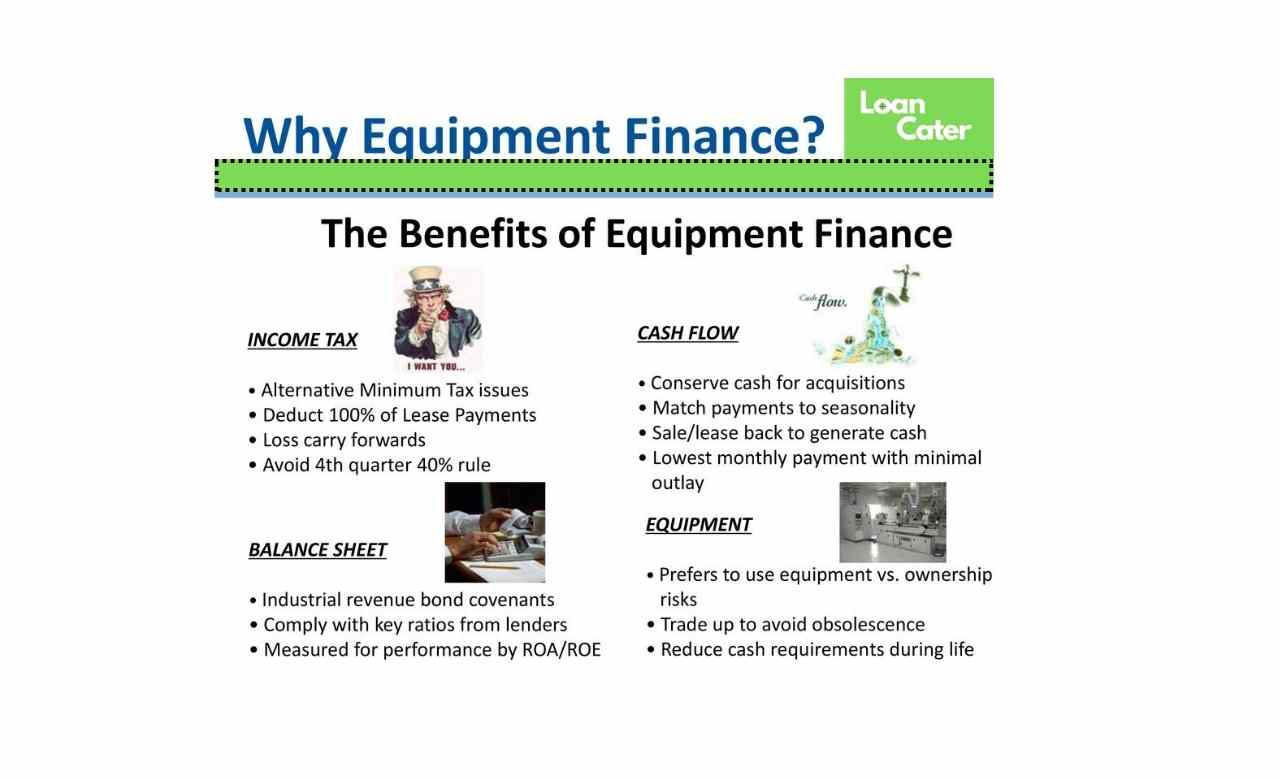

Benefits of Heavy Equipment Financing

Preserving Working Capital for Operational Needs

Operating a small business involves managing day-to-day expenses, and unexpected costs, and ensuring that you have enough liquidity to seize growth opportunities. Investing a significant portion of your working capital into purchasing heavy equipment can strain your resources. Heavy equipment financing allows you to distribute the cost of the equipment over a period of time, ensuring that your working capital remains available for operational necessities.

Predictable Cash Flow with Fixed Monthly Payments

One of the challenges of business planning is dealing with uncertainty. Heavy equipment financing eases this burden by providing fixed monthly payments, making it easier to budget and forecast cash flow. This predictability allows business owners to allocate resources efficiently and confidently, knowing their financial obligations are steady and manageable.

Unlocking Access to High-Quality and Modern Equipment

In the modern business landscape, staying competitive requires staying up-to-date with technological advancements. Investing in the latest equipment can significantly enhance your operational efficiency and productivity. However, the upfront cost can be prohibitive. Heavy equipment financing empowers businesses to access state-of-the-art machinery that might have been out of reach otherwise.

Tax Benefits and Deductions for Financing

Financing heavy equipment may come with tax advantages. Depending on your location and tax laws, the interest paid on your financing may be tax-deductible. This can lead to substantial savings for your business, further bolstering your financial position.

Tailored Repayment Terms for Business Flexibility

Every business has its unique revenue cycles and operational patterns. Heavy equipment financing offers flexibility in choosing repayment terms that align with your business’s financial flows. Whether you opt for short-term or longer-term financing, you can tailor the repayment schedule to match your business’s needs.

Expedited Approval and Acquisition Process

When time is of the essence, heavy equipment financing can be a game-changer. The application process for financing heavy equipment is often quicker than traditional loan applications. Quick approvals mean you can acquire the equipment you need faster, minimizing downtime and maximizing your business’s productivity.

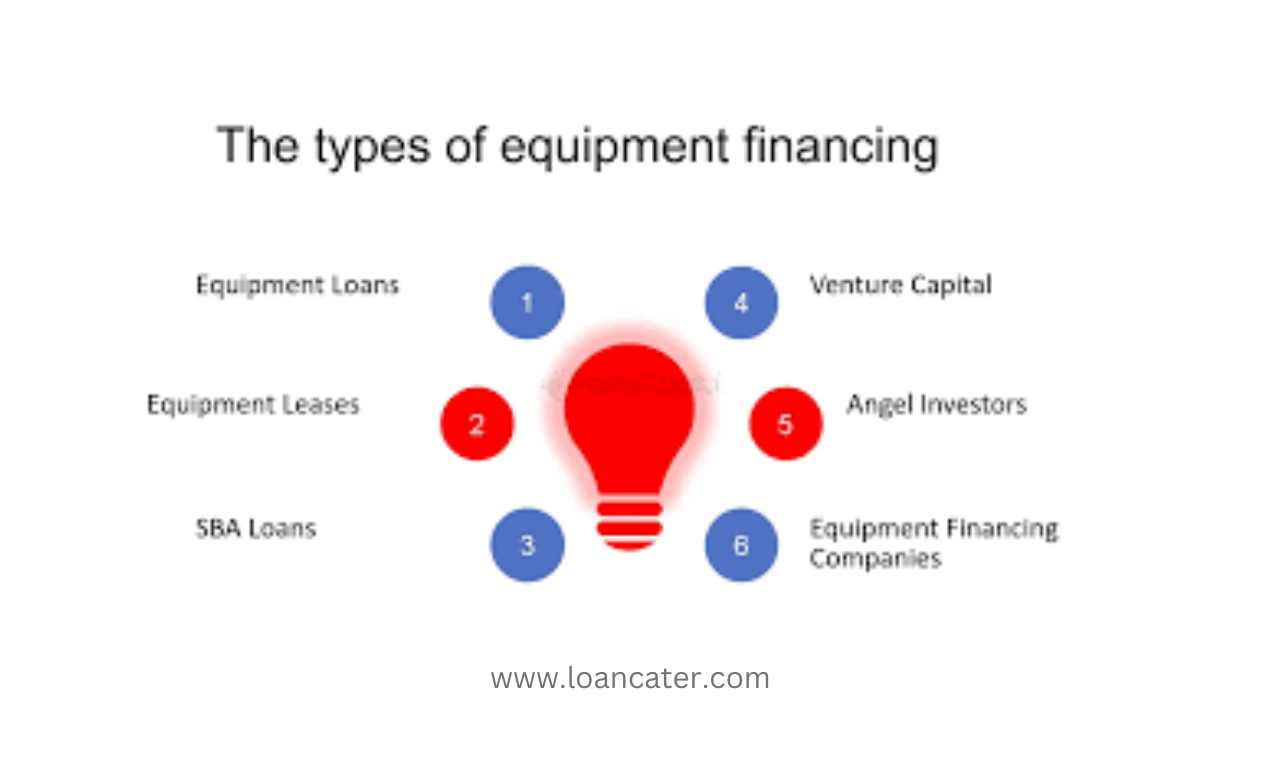

Types of Heavy Equipment Financing

Lease Financing: Advantages and Considerations

Leasing heavy equipment is a popular financing option. With a lease, you essentially rent the equipment for a specified period, typically ranging from one to five years. Leasing offers advantages such as lower monthly payments, potential tax benefits, and the ability to upgrade to newer equipment at the end of the lease term.

However, it’s essential to consider that you won’t own the equipment at the end of the lease, and there might be limitations on customization or modifications.

Equipment Loans vs. Equipment Leases: A Comparative Analysis

Choosing between equipment loans and leases depends on your business’s financial strategy and long-term goals. Equipment loans involve borrowing a lump sum to purchase the equipment, while leases offer the flexibility of lower monthly payments and the option to upgrade. Analyze your business’s needs and consult with financial experts to determine which option aligns with your objectives.

Hire Purchase Agreements: A Flexible Financing Option

A hire purchase agreement is a hybrid between a lease and a loan. With a hire purchase, you make regular payments to “hire” the equipment, with the option to purchase it at the end of the term. This provides flexibility by allowing you to test the equipment’s performance before committing to ownership. However, it’s crucial to understand the terms and conditions, including the total cost and the purchase price at the end of the agreement.

Selecting the Right Equipment Financing

Identifying the Specific Equipment Needs of Your Business

Before diving into heavy equipment financing, conduct a thorough assessment of your business’s equipment needs. Consider factors such as the type of equipment required, the expected lifespan of the equipment, and how it aligns with your business strategy. Understanding your equipment needs ensures that you choose the financing option that best supports your growth goals.

Evaluating Lenders: Reputation, Experience, and Reviews

Choosing the right lender is just as crucial as selecting the right financing option. Research lenders’ reputation, industry experience, and customer reviews. Look for lenders who have a track record of transparent dealings, excellent customer service, and a thorough understanding of your business’s industry and needs.

Assessing Interest Rates, Repayment Terms, and Hidden Fees

Comparing interest rates and repayment terms across different lenders is essential for making an informed decision. Additionally, be vigilant about hidden fees or charges that might not be immediately apparent. Understanding the total cost of financing helps you accurately evaluate the impact on your business’s finances.

Analyzing Down Payment Requirements and No-Money-Down Options

Consider your budget and financial capabilities when evaluating down payment requirements. Some lenders offer no-money-down options, which can be advantageous if you want to conserve your initial cash reserves. However, be aware that no-money-down options might come with higher interest rates or longer repayment terms.

The Application Process

Gathering Documentation for the Financing Application

Prepare the necessary documentation before applying for heavy equipment financing. Common requirements include financial statements, tax returns, business plans, and details about the equipment you intend to finance. Having these documents ready can expedite the application process and increase your chances of approval.

Streamlining the Application Process for Quick Approvals

Many lenders offer streamlined application processes for heavy equipment financing. Online applications and digital document submissions can expedite the approval timeline. Ensure that you provide accurate and complete information to avoid delays in the approval process.

Reviewing the Terms and Conditions of the Financing Agreement

Before signing the financing agreement, thoroughly review the terms and conditions. Pay close attention to interest rates, repayment schedules, any potential penalties for early repayment, and clauses related to ownership or return of the equipment at the end of the term. Seek clarification from the lender if you have any doubts or questions.

Case Studies: Success Stories with Heavy Equipment Financing

Construction Industry: Transforming Operations with Modern Machinery

In the construction industry, heavy equipment is the backbone of projects, from excavation to building structures. Heavy equipment financing enables construction businesses to acquire advanced machinery, enhancing efficiency, accuracy, and safety on the job site. Whether it’s bulldozers, cranes, or excavators, access to state-of-the-art equipment equips construction companies to take on larger projects and deliver superior results.

Agriculture Sector: Enhancing Efficiency through Upgraded Equipment

Agriculture relies heavily on specialized equipment to till, plant, harvest, and process crops. As farms strive to feed a growing global population, leveraging technology and innovation is key. Heavy equipment financing empowers farmers to invest in precision agriculture tools, modern tractors, and other machinery that increases yield, minimizes waste, and contributes to sustainable farming practices.

Manufacturing Sector: Optimizing Production with Cutting-Edge Tools

In manufacturing, the speed and precision of production directly impact profitability. Heavy equipment financing allows manufacturers to acquire advanced machinery, automation systems, and robotics that streamline production processes. By reducing manual labor, improving product quality, and increasing production rates, manufacturers can remain competitive in a global market.

Navigating Challenges and Pitfalls

Balancing Financing Costs with Long-Term Benefits

While heavy equipment financing offers numerous benefits, it’s essential to consider the total cost over the financing term. Calculate the total interest paid and compare it against the potential gains in efficiency, productivity, and revenue. Sometimes, the benefits of upgraded equipment far outweigh the financing costs.

Addressing Potential Risks and Downtime during Equipment Acquisition

Transitioning to new equipment might involve a learning curve for your team. Adequate training and familiarization are essential to minimize disruptions to your operations. Additionally, consider potential downtime during the equipment acquisition process. Collaborate closely with your lender to ensure a smooth transition without significant interruptions.

Avoiding Overcommitment: Aligning Financing with Business Needs

While it’s tempting to acquire the latest and most advanced equipment, make sure the equipment aligns with your actual business needs. Avoid overcommitting by analyzing whether the increased productivity and revenue generated by the equipment justify the financing costs.

Maximizing ROI through Strategic Equipment Financing

Calculating Return on Investment (ROI) for Financed Equipment

Measuring the return on investment (ROI) for financed equipment involves assessing the increased revenue and cost savings the equipment generates compared to the financing costs. By quantifying the tangible benefits, you can make informed decisions about the long-term impact on your business’s bottom line.

Leveraging Enhanced Productivity for Business Expansion

Modern and efficient equipment isn’t just a luxury; it’s a necessity for businesses aiming to expand. Enhanced productivity translates into the ability to take on more projects, service more clients, and grow your business. Financing heavy equipment strategically positions your business for scalability and increased market share.

The Role of Credit Scores in Heavy Equipment Financing

Understanding How Credit Scores Impact Financing Options

Your credit score plays a significant role in determining the financing options available to your business. Lenders use credit scores to assess your creditworthiness and the level of risk associated with lending to your business. Higher credit scores generally result in more favorable financing terms, including lower interest rates and higher borrowing limits.

Exploring Financing Solutions for Businesses with Challenged Credit

Even if your business has a less-than-perfect credit history, there are financing solutions available. Some lenders specialize in working with businesses that have challenged credit. While the terms might not be as favorable, exploring these options can still provide access to the equipment your business needs to grow.

Building Relationships with Financing Partners

Establishing Communication with Lenders for Tailored Solutions

Communication is key when working with financing partners. Establish a clear line of communication to discuss your business’s needs, objectives, and any potential challenges. A collaborative approach ensures that the financing solutions are tailored to your business’s unique requirements.

Maintaining a Long-Term Relationship for Future Equipment Needs

Financing heavy equipment is not just a one-time transaction; it’s the beginning of a partnership. As your business evolves and grows, you may require additional equipment or financing for upgrades. Maintaining a positive relationship with your financing partner enhances your ability to secure future funding quickly and efficiently.

Summary: Empowering Business Growth through Heavy Equipment Financing

In the dynamic landscape of business, having the right tools at your disposal is paramount. Heavy equipment financing offers a strategic solution for businesses seeking to unlock growth and drive productivity. By preserving working capital, providing predictable cash flow, and granting access to modern equipment, financing empowers small businesses to compete and thrive in their respective industries.

Whether you’re in construction, agriculture, manufacturing, or any other sector that relies on heavy equipment, financing can be a catalyst for transformation. By navigating the intricacies of various financing options, understanding the impact of credit scores, and strategically evaluating return on investment, you position your business for success.

In the pursuit of your growth journey, remember that heavy equipment financing is not just about the equipment itself; it’s about the potential it unleashes for your business’s future.

Pertinent FAQs

Can Heavy Equipment Financing Benefit Startups?

Yes, heavy equipment financing can benefit startups. Some lenders specialize in providing financing solutions to new businesses, allowing them to acquire essential equipment without the burden of substantial upfront costs.

How Does Heavy Equipment Financing Compare to Traditional Loans?

Heavy equipment financing is specifically tailored for acquiring equipment, while traditional loans might have broader uses. Financing terms for heavy equipment are often more flexible, and approval processes are streamlined compared to traditional loans.

What Happens If Equipment Requires Maintenance or Repair?

Equipment maintenance and repair are part of the operational reality. Some financing agreements might include clauses related to maintenance responsibilities. It’s crucial to review the terms of the agreement and communicate with your financing partner if unexpected maintenance needs arise.

In the realm of business growth, heavy equipment financing isn’t just a financial transaction; it’s an investment in your business’s future. Embrace the opportunities it offers and embark on a journey of empowerment and expansion.