The business world is ever-evolving, and navigating the financial landscape has become increasingly complex, especially in the face of global challenges like the COVID-19 pandemic. The government has introduced various initiatives to support businesses and their employees in these trying times. The Employee Retention Credit (ERC) program emerged as one such initiative, providing a financial lifeline for struggling businesses.

As a significant extension of this program, the ERC Advance Loan has taken center stage, offering companies even more avenues for economic growth, stability, and recovery. In this comprehensive guide, we will explore the intricacies of ERC Advance Loans, their qualifications, benefits, application process, loan calculation, and much more. By the end of this article, you’ll be well-versed in harnessing the power of ERC Advance Loans to steer your business toward success.

What is the ERC Advance Loan?

Before we delve into the specifics, let’s demystify the ERC Advance Loan. The ERC, which stands for Employee Retention Credit, is a program initiated to help businesses retain their employees during the pandemic. It provides financial incentives for companies that keep employees on their payroll, and it’s been a vital tool for many companies during these turbulent times. The ERC Advance Loan, a derivative of this program, aims to extend further support to businesses by providing them with essential financial resources.

Qualifications for ERC Advance Loan

The ERC Advance Loan is not a one-size-fits-all solution. It’s essential to understand the eligibility criteria. Many businesses qualify if they’ve claimed the ERC and meet specific prerequisites. The program has evolved to accommodate a broader range of companies affected by the pandemic, which means that qualification is more attainable than one might think. We’ll also discuss the significant impact this program has had on businesses during and post-pandemic, shedding light on its adaptability and importance in an ever-changing business landscape.

Benefits of ERC Advance Loan

ERC Advance Loans are more than just financial assistance; they are lifelines for businesses struggling to stay afloat. The program supports businesses and plays a pivotal role in retaining employees. We’ll examine how these loans can be a win-win solution, ensuring financial security for your business while safeguarding the livelihoods of your dedicated workforce.

Applying for the ERC Advance Loan

Navigating the loan application process can be daunting, but we’re here to help. This section will provide a step-by-step guide to simplify the application process. We’ll break down the documentation and forms you must compile to ensure a smooth and successful application.

ERC Advance Loan Amount Calculation

Understanding how ERC Advance Loan amounts are calculated is crucial. We’ll explore the behind-the-scenes formula, providing real-world scenarios to illustrate how it works in practice. This will give you insights into the potential loan amount you might secure for your business.

ERC Advance Loan vs. Traditional Loans

In the world of financing, there’s often more than one way to reach your financial goals. We’ll conduct a comprehensive comparison, pitting ERC Advance Loans against traditional loans. This section will help you decide which option is more suitable for your specific business needs, highlighting the advantages and disadvantages of each.

Using ERC Advance Loan Funds

Receiving the ERC Advance Loan is just the beginning; utilizing the funds is crucial to your business’s future. We’ll guide the permissible uses for the loan and share insights on maximizing its benefits for your business.

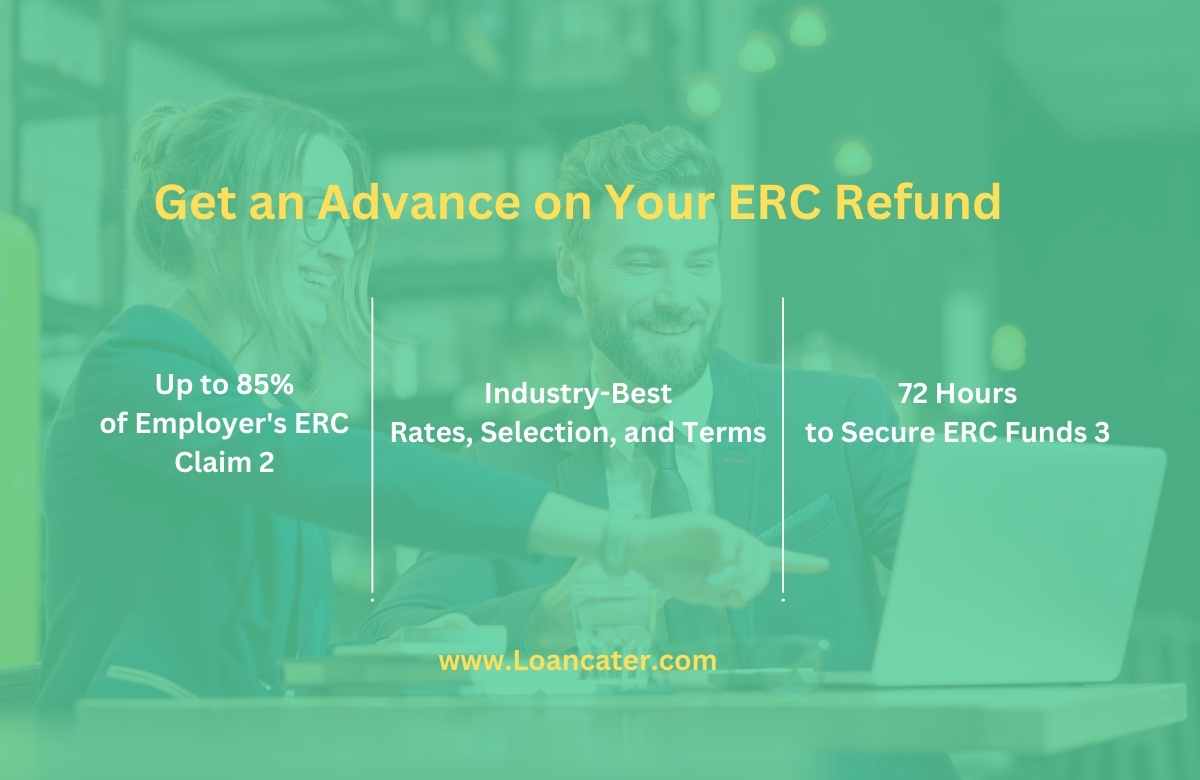

Get Started with ERC Advance Loans with Loancater

As businesses look to secure their financial future and thrive in challenging times, the Employee Retention Credit (ERC) program has emerged as a beacon of hope. And now, with the ERC Advance Loan offered by Loancater, you have a powerful financial tool to unlock your business’s potential. Here’s how you can get started:

Explore ERC Advance Loan Benefits

Begin by understanding the advantages of ERC Advance Loans. These loans provide crucial financial support while helping you retain your valued employees. Explore how the ERC Advance Loan can make a difference for your business.

Check Your Eligibility

Determine if your business qualifies for the ERC Advance Loan. Loancater specializes in working with a wide range of eligible businesses, making this opportunity accessible to many. The program’s flexibility allows more companies to benefit.

Gather Documentation

To start the application process, you’ll need to compile essential documentation and complete the required forms. Our team will guide you through this process, ensuring it’s as straightforward as possible.

Calculate Your Loan Amount

Understand how ERC Advance Loan amounts are calculated. Our experts can help you estimate your potential loan amount based on your business’s circumstances, offering you valuable insights into the funds you could receive.

Consult with Our Experts

At Loancater, we believe in personalized support. Reach out to our experts for a consultation. We’ll guide you through the application process, answer your questions, and provide expert insights.

Maximize Loan Utilization

Explore the permissible uses for ERC Advance Loan funds and strategize how to make the most of this financial support. Our team can provide insights into tailoring the loan to your business’s unique needs.

Stay Compliant

Understanding the regulations and compliance requirements is crucial. We’ll ensure you are well-informed, equipped, and compliant with all the necessary terms, providing a smooth journey throughout the loan period.

Seek Tax Advice

As with any significant financial transaction, it’s essential to consider tax implications. We recommend seeking professional tax advice to ensure your financial strategy aligns with your overall business goals.

Join the Success Stories

As you embark on your journey with an ERC Advance Loan from Loancater, you become a part of a broader success narrative. Your success story could inspire others to explore this valuable financial lifeline.

Conclusion

In conclusion, ERC Advance Loans represent a significant opportunity for businesses to navigate these turbulent times and achieve financial stability and growth. We’ve emphasized these loans’ importance, benefits, and how to secure them successfully. As businesses face constant change and challenge, the ERC Advance Loan is a beacon of hope for many. We encourage you to explore these financial opportunities and utilize them fully.