If you’re a construction business owner with ambitious projects on the horizon, you understand the critical role that financing plays in turning your vision into reality. The right construction loan can be the cornerstone of your success, providing the necessary funds to undertake and complete large-scale construction endeavors. So, how can you secure the best construction loan that suits your specific needs? In this comprehensive guide, we’ll walk you through the steps to ensure you get the most suitable and advantageous construction loan available.

1. Assess Your Project’s Needs

Before diving into the loan application process, it’s essential to have a clear understanding of your project’s financial requirements. Consider the scope of your construction project, including the estimated budget, timeline, and any additional costs that may arise during construction. This assessment will help you determine the precise amount of financing you need.

2. Check Your Credit Score

Your credit score is a crucial factor that lenders consider when evaluating your loan application. While there might not be a strict minimum credit score requirement, having a FICO score above 650 is generally considered ideal. A higher credit score can lead to better loan terms and lower interest rates, ultimately saving you money over the life of the loan.

3. Maintain a Healthy Bank Balance

Lenders often review your bank statements to assess your financial stability. It’s advisable to maintain an ending balance of $1,000 or more in your business bank account. However, this figure can be relative, to keep at least 10% of your monthly deposits in the report. A healthy bank balance demonstrates your ability to manage finances effectively.

4. Show a Consistent Deposit History

Having a history of frequent deposit volumes can boost your credibility in the eyes of lenders. Ideally, you should have ten or more deposits over several months, showcasing a steady cash flow.

5. Ensure a Minimum of One Year in Business

Most lenders prefer to work with construction businesses that have been operating for at least one year. This demonstrates business stability and a commitment to long-term success.

6. Maintain a Healthy Balance Sheet

A strong balance sheet is a reflection of your financial health. While LoanCater can help refinance or consolidate bad debt, it’s advisable not to be over-leveraged. Keeping your balance sheet in good shape shows potential lenders that you’re financially responsible.

7. Demonstrate Growing Revenue

Growing revenue is a positive sign that your construction business is thriving. Lenders want to see that you have the capacity to meet your loan repayments while maintaining business growth.

8. Present a Profitable Profit and Loss (P&L) Statement

A profitable P&L statement indicates that your business is making money and can comfortably manage its financial obligations. This is a significant factor in securing favorable loan terms.

The Loan Application Process

Now that you’re prepared, let’s explore the steps to navigate the loan application process effectively:

a. Determine Your Loan Needs

First, define your project’s financial needs. Knowing the exact amount required and how it will be used will help you choose the right loan type.

b. Gather Financial Documents

Prepare all necessary financial documents, including bank statements, tax returns, and any other records demonstrating your financial health.

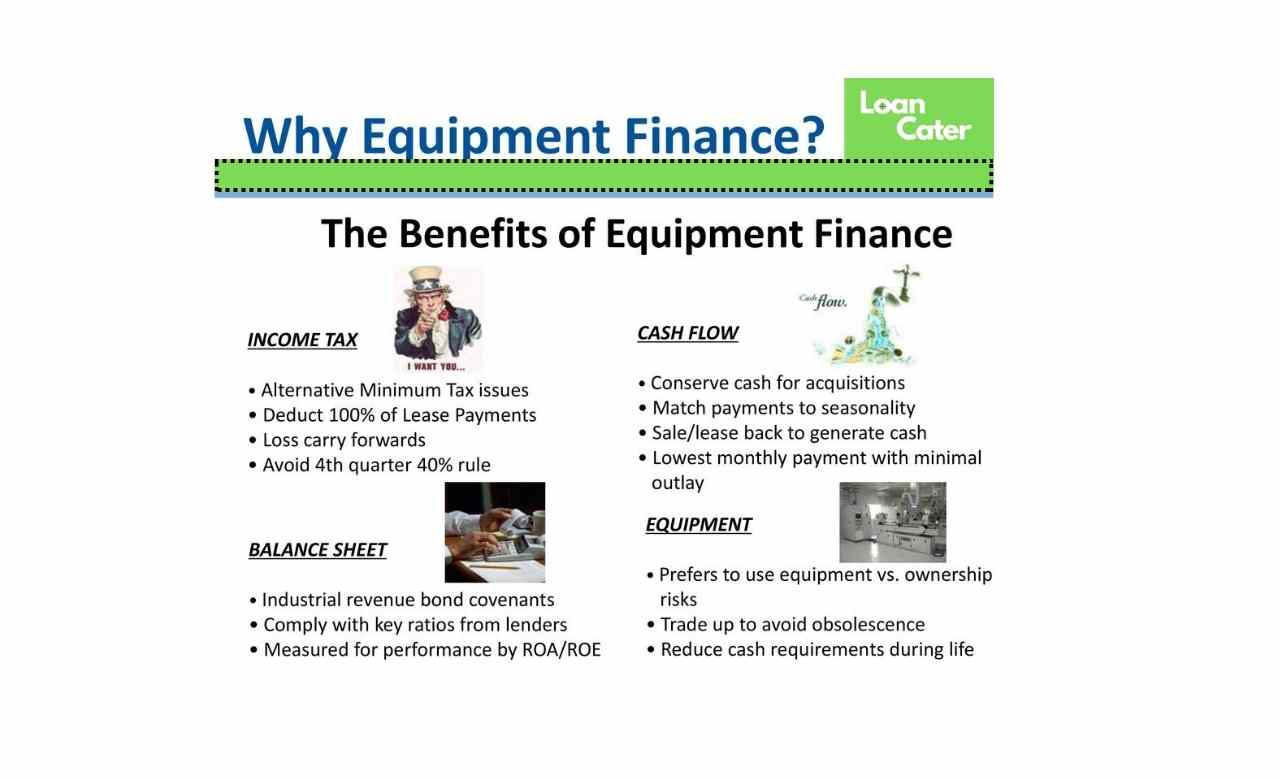

c. Choose the Right Loan Type

At LoanCater, we offer various loan types, including equipment financing loans for construction, term loans, lines of credit, and more. Select the loan type that aligns with your project’s needs and repayment capabilities.

d. Submit Your Application

Complete the loan application accurately and provide all requested information. Ensuring accuracy can expedite the approval process.

e. Wait for Approval

Our expert team will review your application and financial documents. If everything checks out, you’ll receive a loan approval in a reasonable timeframe.

f. Review and Sign the Loan Agreement

Carefully review the terms and conditions of the loan agreement. Once you are satisfied, sign the agreement to finalize the loan.

g. Receive Funds

Upon signing, the loan funds will be deposited directly into your business bank account. You can now commence your construction project with confidence, knowing you have the financial support needed for success.

Conclusion

Securing the best construction loan at LoanCater is not only possible but also achievable when you meet the criteria that funders look for. By maintaining a healthy financial profile and understanding the loan application process, you can access the funds required to bring your construction projects to fruition. LoanCater is your trusted partner in construction financing, offering tailored solutions to empower your business’s growth.

FAQs

- How quickly can I get approved for a construction loan at LoanCater?

The approval process typically takes a few business days, provided you have submitted all required documents accurately and completely.

- Can I refinance or consolidate bad debt with a construction loan from LoanCater?

Yes, LoanCater offers options to refinance or consolidate bad debt, provided your financial situation allows for it.

- What if my credit score is below 650? Can I still qualify for a construction loan?

While a higher credit score is ideal, LoanCater considers various factors when evaluating loan applications. A lower credit score may still qualify you for a loan, although the terms may differ.

- Is there a maximum loan amount I can apply for at LoanCater?

LoanCater offers loan amounts of up to $20 million, providing the flexibility to support both small and large construction projects.

- What is the typical APR for a construction loan at LoanCater?

The typical APR (Annual Percentage Rate) for construction loans at LoanCater starts at 12%, but it can vary based on your financial profile and the loan type selected.