Real estate refinancing can be a strategic financial move, allowing homeowners to improve their mortgage terms, reduce monthly payments, or tap into their home’s equity. However, not everyone can qualify for a real estate refinance. This article will guide you through the essential steps to qualify for a real estate refinance, ensuring that you can make the most of this financial opportunity.

Assessing Your Current Mortgage

Reviewing Your Existing Mortgage Terms

The first step in qualifying for a real estate refinance is to thoroughly understand your current mortgage. Review your mortgage terms, interest rate, and monthly payments. This will help you identify what aspects of your mortgage you want to improve through refinancing.

Checking Your Current Credit Score

Your credit score plays a vital role in determining your eligibility for a refinance. Lenders use your credit score to assess your creditworthiness. Check your credit score with credit reporting agencies and ensure it’s in good shape before applying for a refinance.

Financial Stability

Demonstrating Income Stability

Lenders want to ensure that you have a stable income to make regular mortgage payments. Provide proof of steady employment or a reliable income source. Consistent income can boost your qualification chances.

Reducing Debt-to-Income Ratio

A high debt-to-income (DTI) ratio can be a red flag for lenders. Aim to reduce your DTI by paying down existing debts before applying for a refinance. This can enhance your financial profile.

Property Valuation

Evaluating Your Property’s Current Value

The value of your property impacts the amount you can refinance. Get an appraisal to determine your property’s current market value. A higher valuation can increase your refinancing options.

Enhancing Property Value

Consider making home improvements to boost your property’s value. Upgrades like kitchen renovations or adding a bathroom can increase the worth of your home, potentially leading to better refinancing terms.

Credit Score Improvement

Importance of a Good Credit Score

A good credit score is essential for a favorable refinance. It not only affects your eligibility but also the interest rate you’ll receive. Maintain a healthy credit score by paying bills on time and managing your credit responsibly.

Strategies for Credit Score Improvement

If your credit score is less than ideal, work on improving it. This may involve clearing outstanding debts, disputing inaccuracies on your credit report, or seeking professional credit repair services.

Loan-to-Value Ratio

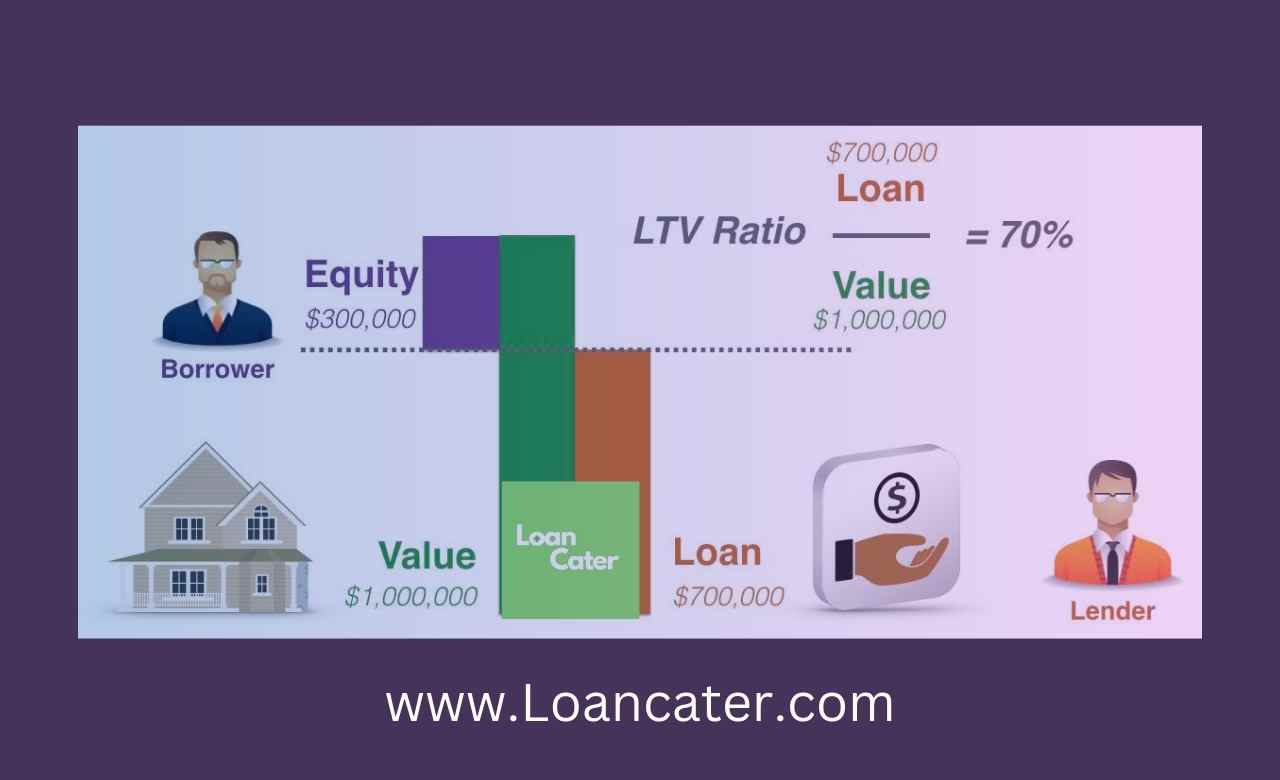

Explaining Loan-to-Value Ratio

The loan-to-value (LTV) ratio compares the amount of your mortgage to your property’s appraised value. Lenders prefer lower LTV ratios as they signify lower risk. A higher LTV ratio can affect your eligibility and interest rates.

Strategies to Improve LTV Ratio

To enhance your LTV ratio, consider making a larger down payment or waiting until your property appreciates in value. A lower LTV ratio can make you a more attractive candidate for refinancing.

Document Preparation

Documents Needed for Refinancing

Gather essential documents for your refinance application, such as income statements, tax returns, and property-related paperwork. Having these ready can expedite the application process.

Tips for Organizing Your Documents

Keep your financial documents well-organized to avoid delays during the application process. Use digital tools or physical folders to store and access your paperwork easily.

Mortgage Refinance Options

Types of Mortgage Refinancing

Understand the various types of mortgage refinancing, including rate-and-term, cash-out, and streamlined refinances. Each type serves different purposes, so choose the one that aligns with your goals.

Choosing the Right Refinancing Option

Select the refinancing option that best suits your needs. For instance, a cash-out refinance allows you to access your home’s equity, while a rate-and-term refinance focuses on changing your interest rate or term.

Shopping for Lenders

Researching Lenders

Not all lenders are the same. Research and compare lenders to find one that offers competitive rates and favorable terms. Look for customer reviews and ask for recommendations.

Comparing Refinancing Offers

Request refinancing offers from multiple lenders. Compare interest rates, closing costs, and loan terms to identify the most cost-effective option.

The Application Process

Step-by-Step Guide to Applying

Follow a step-by-step guide to the application process provided by your chosen lender. Pay attention to deadlines and required documentation.

Common Pitfalls to Avoid

Be aware of common pitfalls during the application process, such as missing deadlines or providing incomplete information. Avoiding these can smoothen your refinancing journey.

Loan Approval and Closing

What to Expect After Application

Once your application is submitted, anticipate the lender’s decision. The approval process may involve additional document requests or a home appraisal.

Closing the Refinancing Deal

If approved, you’ll proceed to the closing phase. Sign the necessary paperwork, pay closing costs, and complete the refinance process.

Alternatives to Refinancing

When Refinancing Isn’t an Option

In some cases, refinancing may not be the best solution. Explore alternatives, such as loan modification or seeking financial counseling.

Exploring Alternative Financing Methods

Consider alternative financing methods like home equity lines of credit (HELOCs) or personal loans. These can provide short-term relief if refinancing is not viable.

Conclusion

In conclusion, qualifying for a real estate refinance involves several critical steps. These include assessing your current mortgage, improving your financial stability, enhancing your property’s value, and understanding your credit score’s significance. Choosing the right refinancing option, shopping for lenders, and navigating the application process are essential components of a successful refinance journey. Remember that alternatives exist if refinancing doesn’t align with your goals. By following these steps, you can improve your chances of securing a real estate refinance that benefits your financial future.

Frequently Asked Questions

FAQ 1: What credit score is needed for real estate refinancing?

To qualify for real estate refinancing, a good credit score typically falls within the range of 620 to 850. However, the specific credit score requirements may vary among lenders.

FAQ 2: Can I refinance with bad credit?

While it may be challenging, it’s possible to refinance with bad credit. You may need to work on improving your credit score, explore alternative lenders, or consider government-backed refinance programs.

FAQ 3: How long does the real estate refinancing process take?

The real estate refinancing process can vary in duration, but it often takes 30 to 45 days from application to closing. However, it may be longer if there are complications or delays.

FAQ 4: What documents are required for refinancing?

Commonly required documents for refinancing include proof of income, tax returns, bank statements, and property-related paperwork. Your lender will provide a specific list of required documents.

FAQ 5: What are the closing costs for real estate refinancing?

Closing costs for real estate refinancing typically range from 2% to 5% of the loan amount. These costs cover various fees, such as loan origination, appraisal, and title insurance.