In the ever-evolving landscape of business, debt can become a heavy anchor, hindering growth and stifling progress. Whether you run a small startup or a well-established company, managing your business debt is essential for financial health. This guide will walk you through the intricacies of business debt refinance, shedding light on how it can be a lifeline for your enterprise.

Types of Business Debt

Before diving into the world of debt refinance, it’s vital to understand the different types of business debt:

1. Short-Term Loans

These are typically used for immediate expenses, with shorter repayment terms. Common examples include working capital loans and lines of credit.

2. Long-Term Loans

Long-term loans are used for larger investments like equipment or real estate. They come with extended repayment periods, often years.

3. Lines of Credit

Business lines of credit offer flexibility, allowing you to borrow funds up to a predetermined limit. You only pay interest on what you use.

4. Merchant Cash Advances

This option allows you to receive a lump sum in exchange for a percentage of your daily credit card sales.

When to Consider Refinancing

Refinancing can be a game-changer when:

High-Interest Rates

If you’re struggling with high-interest rates on your current loans, refinancing can help secure lower rates.

Improved Credit Score

A better credit score can qualify you for better loan terms, making refinancing an attractive option.

Changing Business Conditions

If your business has evolved or faced unforeseen challenges, your current debt structure might no longer be suitable.

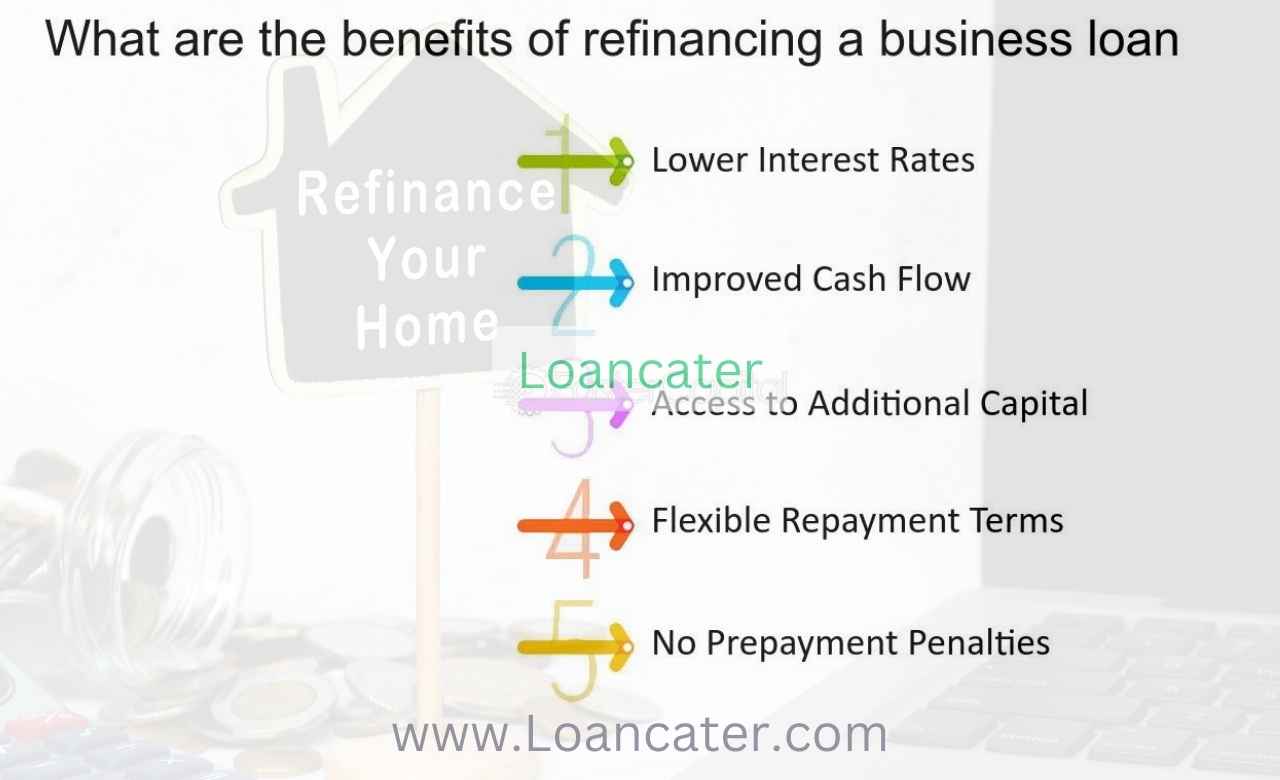

Benefits of Business Debt Refinance

The advantages of debt refinance include:

Lower Interest Rates

Securing a loan with a lower interest rate can lead to significant savings over time.

Extended Repayment Terms

Refinancing often comes with extended repayment periods, reducing monthly financial strain.

Single Monthly Payment

Consolidating your debts means you only have one monthly payment to manage, simplifying your financial obligations.

Improved Cash Flow

Lower interest rates and reduced monthly payments can improve your cash flow, providing more working capital.

Risks and Challenges

While debt refinance offers numerous benefits, it’s essential to be aware of the risks:

Impact on Credit Score

Applying for refinancing may result in a temporary dip in your credit score.

Hidden Fees

Be cautious of hidden fees or charges associated with the refinance process.

Eligibility Criteria

Not all businesses may meet the criteria for favorable refinancing terms, especially if your financial health has deteriorated.

Choosing the Right Lender

Selecting the right lender is a critical step in the refinancing process. Options include:

Traditional Banks

Brick-and-mortar banks often offer competitive rates and personalized service.

Online Lenders

Online lenders provide convenience and may have more flexible eligibility criteria.

SBA Loan Options

The Small Business Administration (SBA) offers loan programs that can be used for debt refinance.

Application Process

The refinancing journey typically involves:

Gathering Financial Documents

Prepare financial statements, tax returns, and other required documents.

Completing the Application

Submit your application to the chosen lender, including details about your existing debts.

Credit Check and Approval

The lender will review your application, conduct a credit check, and decide whether to approve your refinance request.

SBA Debt Refinancing Program

The SBA offers a Debt Refinancing Program aimed at assisting small businesses. It can be an attractive option due to:

Eligibility Criteria

Eligible businesses can refinance existing debts, including expensive merchant cash advances.

Benefits of SBA Refinancing

SBA loans typically have low-interest rates and favorable terms, making them an excellent choice for many businesses.

Application Process

The application process for SBA debt refinancing involves working with an SBA-approved lender and providing documentation similar to traditional refinancing.

Consolidating Business Debt

Consolidating your debts simplifies your financial landscape:

Merging Multiple Loans

Combine multiple loans into a single, manageable debt.

Calculating Total Debt

Determine the total amount of debt you wish to consolidate.

Refinancing Strategy

Select the best refinancing option, considering interest rates, terms, and your business’s specific needs.

Alternative Refinancing Options

Explore alternative refinancing methods:

Debt Consolidation Loans

These loans are designed specifically for consolidating multiple debts.

Business Debt Settlement

Negotiate with creditors to settle debts for less than what you owe.

Business Debt Counseling

Seek professional guidance to manage and repay your debts effectively.

Avoiding Common Refinancing Pitfalls

Navigate the refinancing process wisely:

Overextending Debt

Avoid the temptation to take on more debt than your business can handle.

Ignoring Hidden Costs

Read the fine print and be aware of any hidden fees or charges.

Failing to Compare Offers

Obtain quotes from multiple lenders to ensure you secure the best refinancing deal.

Financial Planning After Refinancing

Post-refinancing, prudent financial management is crucial:

Budgeting for Repayments

Create a budget that accounts for your new, consolidated debt and ensures timely payments.

Building an Emergency Fund

Establish an emergency fund to handle unexpected expenses without resorting to additional debt.

Business Growth Strategies

Use your improved financial position to invest in business growth and expansion.

FAQs (Frequently Asked Questions)

Can business loans be refinanced?

Yes, business loans can be refinanced, much like personal loans or mortgages. Business loan refinancing involves replacing your existing loan(s) with a new one, typically at more favorable terms.

How do businesses refinance debt?

To refinance debt, businesses follow these steps:

- Review existing debt: Assess the terms, interest rates, and maturity dates of current loans.

- Shop for lenders: Research lenders offering favorable refinance options.

- Apply for new loan: Submit an application to the chosen lender.

- Pay off existing debt: Use the new loan to repay the old ones.

- Benefit from better terms: Enjoy lower interest rates, longer repayment periods, or improved loan structures.

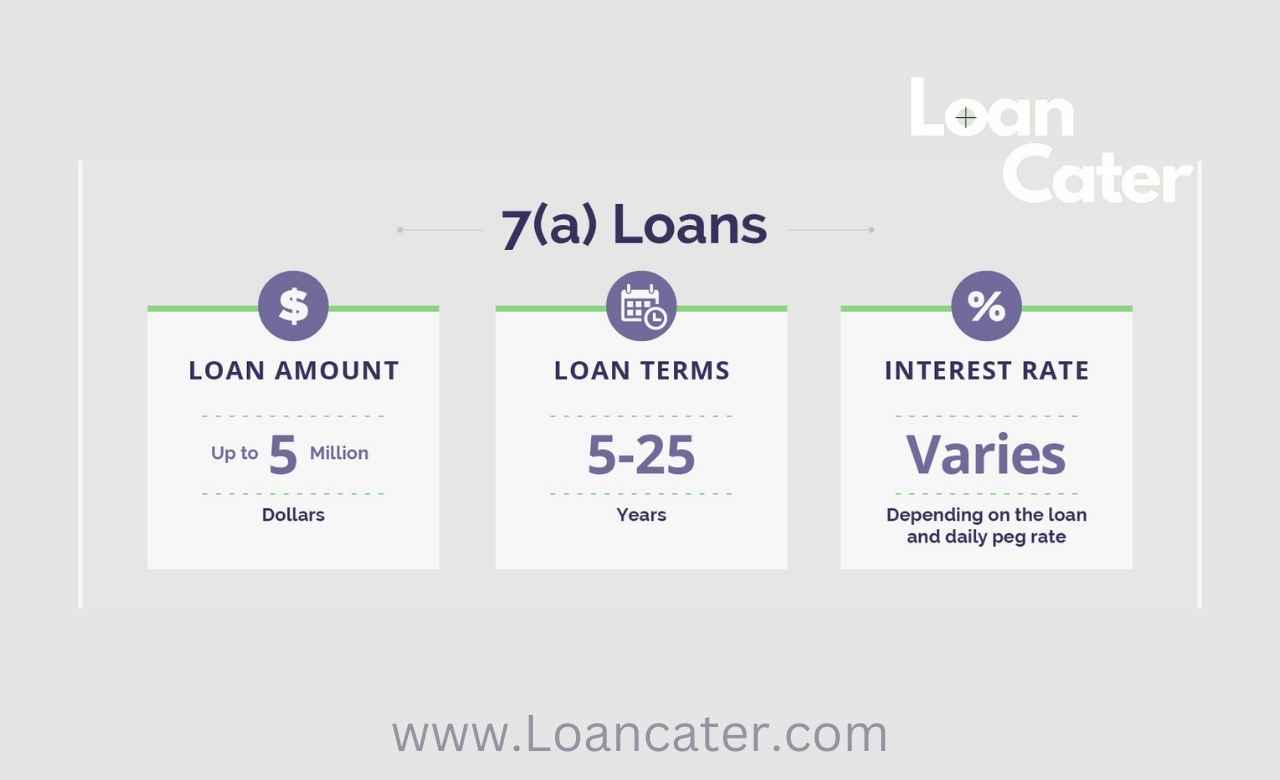

Can SBA loans be used to refinance?

Yes, the Small Business Administration (SBA) offers loan programs that allow businesses to refinance certain existing debts. The SBA 7(a) Loan Program, for instance, permits debt refinancing under specific conditions.

What is a business refinance?

Business refinancing is the process of replacing an existing business loan with a new one, often to secure more favorable terms. It can involve consolidating multiple debts into a single loan, lowering interest rates, extending repayment terms, or improving overall loan terms to reduce financial strain and enhance business stability.

In summary, business debt refinance can be a strategic move to improve your financial health, reduce costs, and simplify your financial obligations. While it offers numerous benefits, it’s essential to be aware of potential risks and navigate the process carefully. With the right strategy and lender, you can unburden your business from the weight of excessive debt and set it on a path to financial stability.