In the dynamic landscape of business financing, entrepreneurs often require access to capital to start or grow their businesses. Traditional loans, though readily available, often demand collateral or equity as security, making them less appealing for those unwilling or unable to pledge their personal or business assets.

This is where no equity business loans come into play, offering a flexible and accessible funding solution. In this comprehensive guide, we’ll delve into the world of no equity business loans in the USA. From understanding the basics to exploring their advantages and risks, eligibility criteria, application process, alternatives, and real stories of success, we’ll equip you with the knowledge needed to make informed financing decisions.

Understanding the Basics of No Equity Business Loans

No equity business loans are a category of business financing that does not require borrowers to pledge collateral or equity to secure the loan. Instead, these loans are typically approved based on the borrower’s creditworthiness, business plan, and financial stability.

The Growing Demand for Non-Traditional Financing

In recent years, there has been a surge in the demand for non-traditional financing options, driven by the desire for greater flexibility and accessibility in business funding. No equity business loans have emerged as a popular choice for startups, small businesses, and entrepreneurs looking to secure capital without risking their assets.

The Essentials of No Equity Business Loans

What Are No Equity Business Loans?

No equity business loans are financial products designed to provide businesses with access to capital without requiring them to offer collateral or equity in return. These loans are unsecured, meaning they are not backed by specific assets.

When Are They the Right Choice?

Understanding when to consider a no equity business loan is crucial. We’ll explore the circumstances in which these loans are the ideal financing solution.

Types of No Equity Business Loans

Unsecured Business Loans

Unsecured loans are a common form of no equity business financing. They offer fixed loan amounts and interest rates based on the borrower’s creditworthiness.

Business Lines of Credit

A business line of credit provides borrowers with a revolving credit line they can draw from as needed. Interest is only charged on the amount borrowed.

Merchant Cash Advances

Merchant cash advances offer quick access to cash by selling a portion of future credit card sales. These advances are ideal for businesses with fluctuating revenue.

Invoice Financing

Invoice financing allows businesses to leverage their outstanding invoices to secure immediate funding.

Revenue-Based Financing

Revenue-based financing provides capital in exchange for a percentage of future revenues, making repayments contingent on business performance.

Advantages of No Equity Business Loans

No Risk to Personal Assets

One of the most significant advantages of no equity business loans is that they do not require borrowers to pledge personal or business assets as collateral.

Speedy Approval Process

Compared to traditional loans, no equity business loans often feature faster approval processes, ensuring businesses can access the funds they need promptly.

Ideal for Startups

Startups with limited assets or established credit histories find these loans particularly appealing as they provide a financing lifeline.

Improved Cash Flow

No equity business loans can enhance cash flow by providing a cushion for operational expenses or growth initiatives.

Flexibility in Use

Borrowers have the flexibility to use the loan funds as needed, whether for expansion, inventory purchases, marketing campaigns, or other business needs.

Risks and Challenges

Higher Interest Rates

While these loans offer accessibility, they typically come with higher interest rates compared to traditional loans, which can impact the cost of borrowing.

Stricter Eligibility Criteria

Lenders may impose stringent eligibility criteria, such as higher credit score requirements, to mitigate the risk associated with unsecured loans.

Limited Loan Amounts

No equity business loans may have lower maximum loan amounts compared to secured loans, limiting the capital available for significant projects.

Potential for Debt Trap

Without collateral, borrowers must rely on their cash flow to repay the loan, potentially straining finances.

Eligibility Criteria

Credit Score Requirements

Lenders often consider the borrower’s credit score when evaluating eligibility for no equity business loans.

Business Age and Revenue

The age and revenue of the business can influence a lender’s decision, with established businesses having an advantage.

Business Plan and Purpose

A well-structured business plan that outlines the use of loan funds can enhance eligibility.

Industry and Market Conditions

The industry in which the business operates and the prevailing market conditions can impact eligibility and terms.

The Application Process

Gathering and Preparing Required Documents

We’ll guide you through the process of collecting and organizing the necessary documents for your loan application.

Finding the Right Lender

Choosing the right lender is critical. We’ll explore factors to consider when selecting a lender.

Completing the Loan Application

A step-by-step overview of completing a no equity business loan application, including tips for success.

Waiting for Approval

Understanding the approval timeline and what to expect during the waiting period.

Alternatives to No Equity Business Loans

Grants and Competitions:

Explore grants and business competitions that offer non-repayable funds to support your business. Many organizations and government agencies provide grants for specific industries and initiatives.

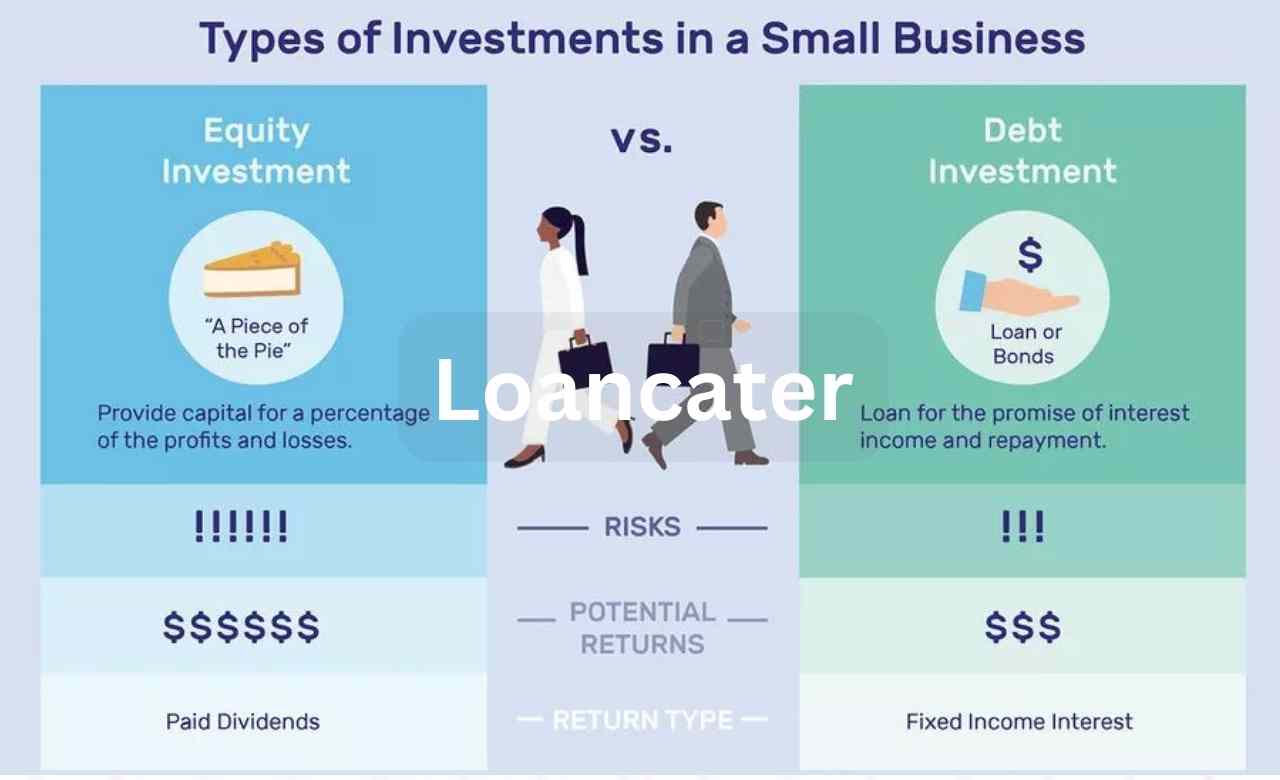

Equity Financing:

Instead of taking on debt, you can consider equity financing, where you sell a portion of your business ownership to investors in exchange for capital. This option is common for startups and high-growth companies.

Personal Savings and Family Contributions:

Some entrepreneurs use their personal savings or contributions from family and friends to fund their businesses. While it doesn’t involve external debt, it’s essential to manage these funds responsibly.

Peer-to-Peer Lending:

Peer-to-peer lending platforms connect borrowers with individual investors willing to fund loans. These loans often have competitive interest rates and may be easier to qualify for than traditional bank loans.

Business Grants:

Research and apply for business grants offered by government agencies, nonprofits, and private organizations. Grants are typically non-repayable funds awarded for specific purposes, such as research and development or community projects.

Angel Investors:

Angel investors are individuals or groups who provide capital to startups and small businesses in exchange for equity ownership. They can offer mentorship and industry expertise in addition to funding.

Venture Capital:

For high-growth startups, venture capital firms can provide substantial funding in exchange for equity. Venture capitalists typically seek businesses with significant growth potential.

Tips for a Successful Loan Application

Checking and Improving Your Credit Score

Actionable steps to assess and enhance your credit score before applying for a loan.

Crafting a Solid Business Plan

A well-crafted business plan can increase your chances of loan approval. Learn how to create an effective plan.

Understanding Your Financials

Key financial metrics and statements to have a firm grasp of before discussing loan terms with lenders.

Exploring Government Programs

Information on government-backed loan programs and how they can benefit your business.

Comparing Lenders

Guidance on evaluating and comparing lenders to identify the best fit for your financing needs.

Frequently Asked Questions (FAQs) About No Equity Business Loans:

What Credit Score Is Needed for No Equity Business Loans?

The credit score requirements for no equity business loans can vary depending on the lender and the type of loan. Generally, a higher credit score increases your chances of approval. However, some lenders offer options for businesses with lower credit scores.

Can Startups Get No Equity Business Loans?

Yes, startups can potentially qualify for no equity business loans. Some lenders specialize in providing financing to new businesses. Startups may need to demonstrate a solid business plan, revenue projections, and a strong credit history to qualify.

How Long Does the Approval Process Take?

The approval process for no equity business loans can vary from a few days to a few weeks. It depends on factors such as the lender’s requirements, the complexity of the loan application, and the completeness of your documentation. Some online lenders offer faster approval processes.

Are Interest Rates Higher for No Equity Loans?

Interest rates for no equity business loans can vary widely. They depend on factors like your creditworthiness, the lender’s policies, and the type of loan. While some no equity loans may have higher interest rates than secured loans, others offer competitive rates, especially if you have a strong credit history.

What Happens if I Can’t Repay the Loan?

If you’re unable to repay a no equity business loan, the consequences can vary based on the loan agreement. Some lenders may work with you to modify the repayment terms. Others may charge late fees or report missed payments to credit bureaus, which can affect your credit score. In extreme cases, the lender may pursue legal action or seize collateral, depending on the loan type.

Conclusion

Making Informed Financing Decisions with No Equity Business Loans

A recap of the key takeaways from this guide, empowering businesses to make informed financing decisions.

Securing Your Business’s Future without Sacrificing Equity

The closing thoughts on the significance of no equity business loans as a tool for business growth and resilience.

By the end of this guide, you will have a comprehensive understanding of no equity business loans, their advantages, risks, and alternatives, enabling you to navigate the financing landscape with confidence and clarity.