In today’s competitive business landscape, securing the right financing can be the key to success. Whether you’re a small startup or an established company, access to capital is crucial for growth and expansion. In this article, we will explore a unique financing option that doesn’t require traditional collateral – No Collateral Business Loans. These financial solutions are tailored to meet the needs of businesses looking to secure funding without putting their assets on the line.

The Vital Role of Business Loans

Business loans play a vital role in the growth and development of companies. They provide the necessary capital for various purposes, from launching a new product line to expanding operations or even weathering unexpected financial challenges. However, one traditional hurdle in securing a business loan has been the requirement for collateral.

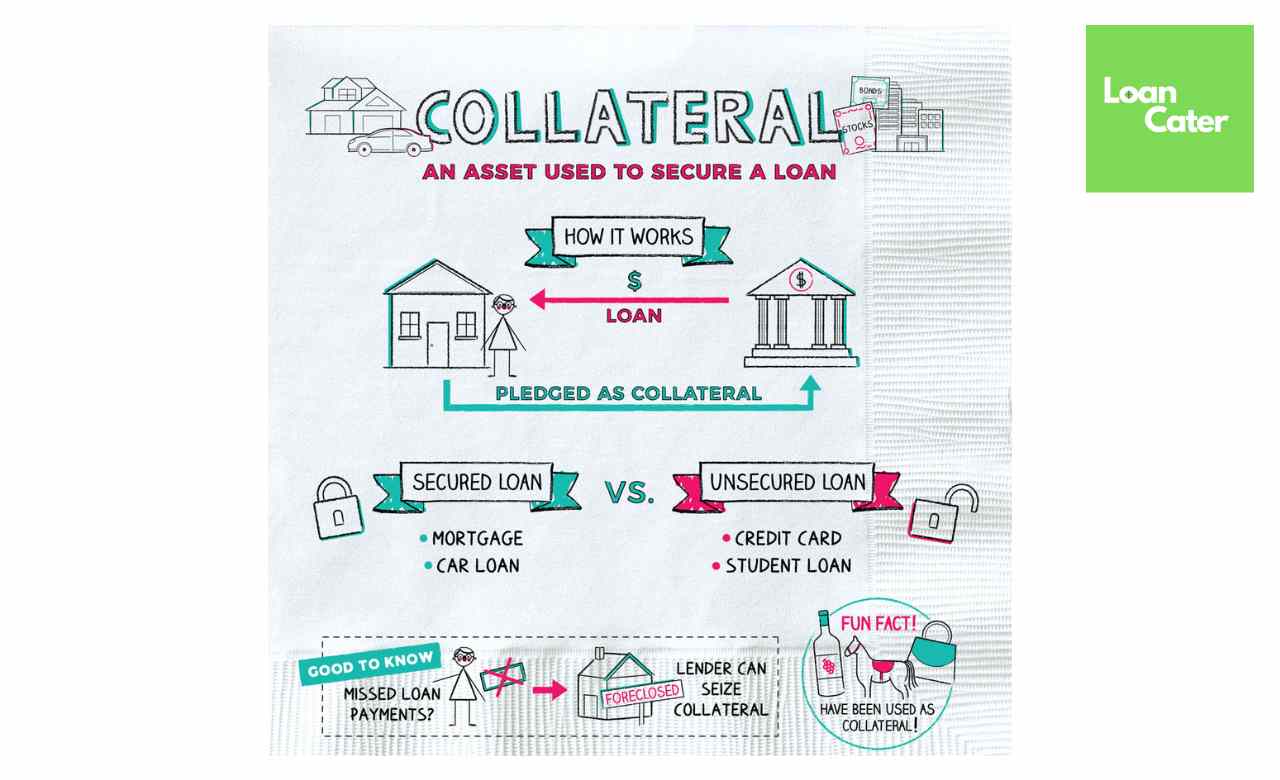

The Collateral Conundrum:

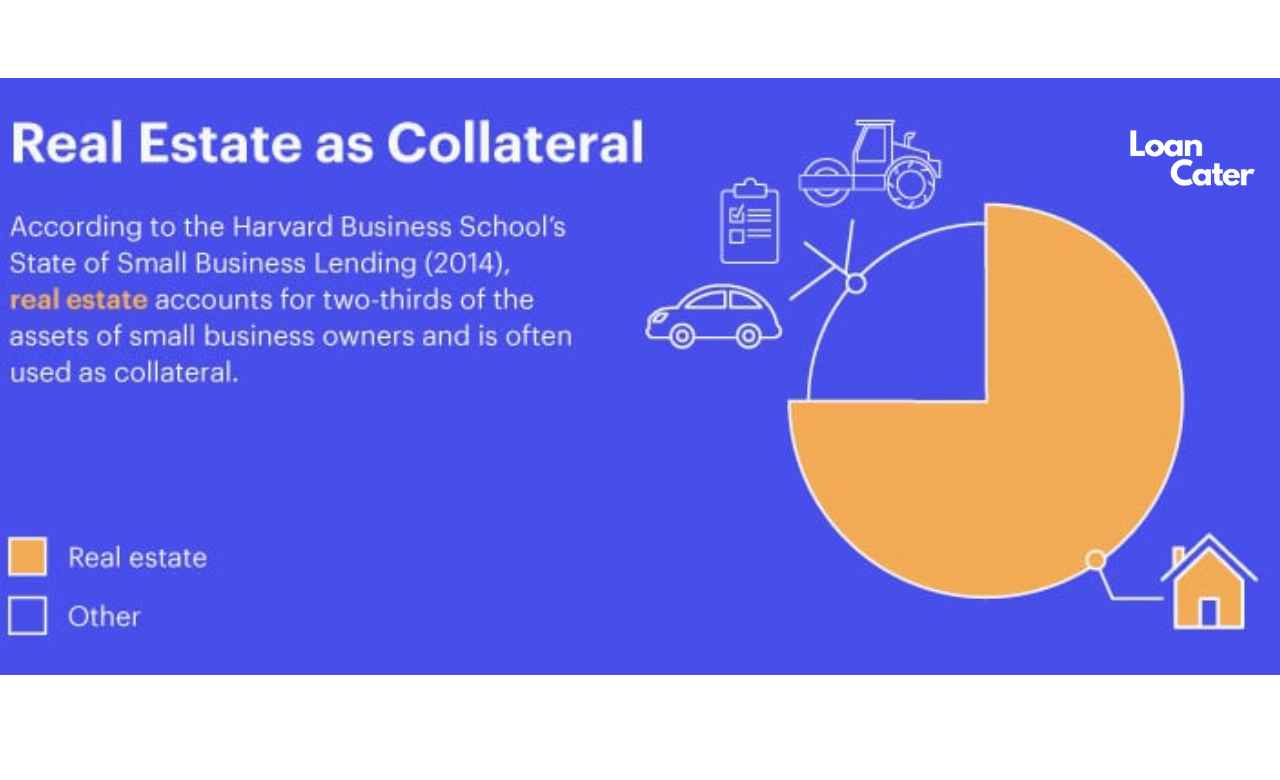

Traditional lenders often demand collateral, such as real estate or assets, as security for the loan. While this approach reduces the lender’s risk, it can be a significant barrier for many businesses. Not everyone has valuable assets to pledge, and for startups, this requirement can be particularly challenging.

No Collateral Business Loans:

A Brief Overview: No Collateral Business Loans, as the name suggests, offer a refreshing alternative. They provide access to much-needed funds without the need for traditional collateral. Instead, lenders evaluate loan applications based on factors like creditworthiness, business performance, and the ability to repay.

What Are No Collateral Business Loans?:

No Collateral Business Loans are unsecured loans that allow businesses to borrow funds without putting up assets as collateral. These loans rely on other factors, such as credit history and business revenue, to determine eligibility and terms.

How Do They Work?

The process typically starts with the business owner applying for the loan. Lenders review the application and assess the applicant’s creditworthiness, business financials, and overall risk. If approved, the funds are disbursed, and the borrower agrees to a repayment plan.

Types of No Collateral Loans: There are various types of No Collateral Business Loans available, each catering to specific business needs. These may include term loans, lines of credit, and merchant cash advances, among others.

Advantages of No Collateral Business Loans:

Asset Protection: One of the primary advantages of no collateral loans is asset protection. Business owners don’t have to risk their personal or business assets, making it a safer option.

Faster Approval: Since there’s no need for lengthy collateral evaluations, the approval process for no collateral loans is often faster, providing quick access to funds when needed.

Streamlined Application: The application process is typically more straightforward, requiring less paperwork compared to traditional loans, which can be a relief for busy entrepreneurs.

Suitable for Startups: No collateral loans are often more accessible to startups and newer businesses that may not have substantial assets to pledge.

Improved Cash Flow: These loans can provide an injection of working capital, helping businesses manage cash flow challenges or seize growth opportunities.

In the following sections, we will delve deeper into each of these aspects, exploring the different types of no collateral loans available and providing insights into how businesses can benefit from this financing option. Stay tuned for a comprehensive guide on navigating the world of No Collateral Business Loans!

Challenges and Risks:

Obtaining a business loan can be a beneficial step for your company’s growth, but it comes with its fair share of challenges and risks. Some of the primary challenges include facing higher interest rates, stricter eligibility criteria, and the possibility of receiving lower loan amounts. To navigate these challenges successfully, it’s crucial to understand the eligibility criteria in detail and prepare your business accordingly.

Higher Interest Rates: One of the significant challenges when seeking a business loan is the potential for higher interest rates. Lenders often charge higher interest to compensate for the risk associated with lending to businesses. To mitigate this risk, it’s essential to maintain a strong credit profile, explore various lenders to compare rates, and consider different loan options that might offer more favorable terms.

Stricter Eligibility Criteria:

Lenders impose strict eligibility criteria to ensure they lend to businesses with a higher likelihood of repayment. These criteria may include credit score requirements, minimum business age, and revenue thresholds. To meet these criteria, you should work on improving your credit score, establish a solid business history, and carefully assess whether your business aligns with the lender’s requirements.

Lower Loan Amounts: Lenders may offer lower loan amounts than what you initially anticipated. This can be a significant challenge for businesses with ambitious expansion plans. To address this, you can explore alternative sources of funding, such as equity financing or seeking additional investors, to bridge the gap between your funding needs and what the lender offers.

Eligibility Criteria: Understanding and meeting the eligibility criteria is crucial when applying for a business loan. Here are the key factors that lenders typically consider:

- Credit Score: A higher credit score increases your chances of approval and may lead to better loan terms.

- Business Age and Revenue: Lenders often prefer businesses with a track record of success. A longer business history and higher revenue can enhance your eligibility.

- Business Plan and Purpose: A well-structured business plan that outlines how the loan will be used and repaid can make a strong case for approval.

- Industry and Market Conditions: Lenders may assess the stability and growth potential of your industry and market before approving a loan.

The Application Process:

Navigating the business loan application process can be complex. It involves several stages, from preparing your documents to waiting for approval. Here’s an overview of these stages:

Preparing Your Documents: Before applying for a business loan, gather essential documents, including financial statements, tax returns, business plans, and any other documentation required by the lender. Organizing these documents in advance can expedite the application process.

Finding the Right Lender: Choosing the right lender is crucial. Research various lenders, including traditional banks, online lenders, and credit unions, to find one that aligns with your business’s needs and offers competitive terms.

Completing the Application: Once you’ve selected a lender, complete the loan application accurately and thoroughly. Be prepared to provide detailed information about your business’s finances, operations, and loan purpose.

Waiting for Approval: After submitting your application, be patient while waiting for approval. The approval process can take time as lenders review your application, conduct credit checks, and assess the risk associated with your business. Be ready to respond to any additional inquiries from the lender during this period.

Alternatives to No Collateral Business Loans:

Business Lines of Credit:

Explore the option of a business line of credit, which provides flexibility similar to no collateral loans. With a line of credit, you can access funds as needed and only pay interest on the amount borrowed.

Merchant Cash Advances:

Merchant cash advances offer quick access to capital by advancing funds based on your future credit card sales. While convenient, they often come with higher fees and shorter repayment terms.

Crowdfunding:

Consider crowdfunding platforms to raise funds for your business. Crowdfunding allows you to gather financial support from a community of backers, but success depends on your campaign’s appeal.

Grants and Competitions:

Look for business grants and competitions that align with your industry or goals. Winning grants can provide non-repayable funding for specific projects or initiatives.

Tips for a Successful Loan Application:

Check and Improve Your Credit Score:

Review your credit report for errors and take steps to improve your credit score if needed. A higher credit score can enhance your loan eligibility.

Craft a Solid Business Plan:

Create a comprehensive business plan that outlines your objectives, strategies, and how the loan will benefit your business. Lenders appreciate well-thought-out plans.

Understand Your Financials:

Demonstrate a strong understanding of your business’s financials, including cash flow, profit margins, and revenue projections. This showcases your financial responsibility.

Explore Government Programs:

Investigate government-backed loan programs that can provide favorable terms to businesses, especially startups and underserved communities.

Compare Lenders:

Shop around and compare different lenders, considering their interest rates, fees, and repayment terms. Finding the right lender can make a significant difference in your financing experience.

FAQs:

What credit score is needed for no collateral business loans?

Discover the typical credit score requirements for no collateral business loans and how to improve your creditworthiness.

Can startups get no collateral business loans?

Explore options for startups seeking financing without collateral and the challenges they may encounter.

How long does the approval process take?

Understand the factors affecting approval timelines and how to expedite the process when necessary.

Are interest rates higher for no collateral loans?

Learn about interest rate considerations for no collateral loans and strategies for securing competitive rates.

What happens if I can’t repay the loan?

Explore potential consequences of loan default and steps to take if you encounter difficulties in repayment.

Conclusion:

Securing Your Business’s Future Without Collateral: Summarize the key takeaways from the article, emphasizing the importance of informed decision-making and exploring diverse financing options to propel your business forward.