Welcome to Loancater, where we understand the unique financial needs of the construction industry. In this article, we’ll delve into the world of construction finance, exploring its significance, various types, and why Loancater is your go-to partner for construction financing. Whether you’re a residential builder, a commercial developer, or involved in public works, we have tailored solutions to fuel your construction projects’ success.

Understanding Construction Finance

What is Construction Finance?

Construction finance, in its essence, is the lifeline of the construction industry. It provides the necessary capital to cover project costs, pay contractors and suppliers, and ensure the seamless progress of construction endeavors.

The Importance of Construction Finance in the Industry In the construction world, time is money. Delays due to lack of funds can be costly. Construction finance keeps your project on track by providing the financial means to keep things moving smoothly.

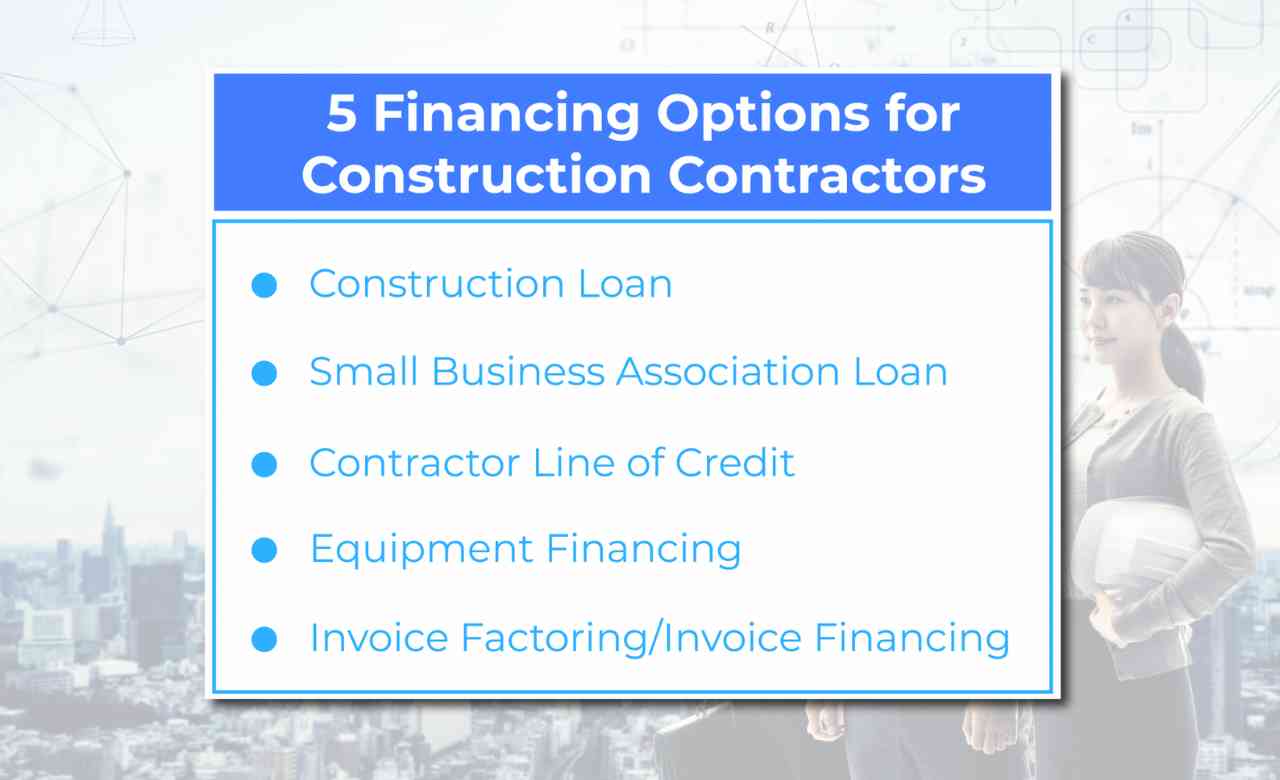

Short-term Construction Loans

Immediate Financial Support

Short-term construction loans are designed to provide immediate financial support for your construction project. These loans are perfect for addressing unexpected costs that may arise during the project or for bridging gaps in cash flow.

Flexible Terms

Short-term loans usually come with flexible terms and relatively quick approval processes, allowing you to access the necessary funds promptly. They are suitable for smaller to medium-sized projects or when you need rapid financing for a part of your construction.

Long-term Construction Loans

Extended Repayment Periods

Long-term construction loans, as the name suggests, come with extended repayment periods. These loans are ideal for large-scale construction projects where repayment might take several years. They provide the financial stability required for the completion of substantial endeavors.

Lower Monthly Payments

Due to their extended terms, long-term loans typically have lower monthly payments compared to short-term loans. This can ease the financial burden on your construction project.

Equipment Financing for Construction

Investing in Heavy Machinery

Acquiring and maintaining heavy machinery is crucial in the construction industry. Equipment financing specifically targets the purchase or leasing of construction equipment. This type of financing ensures you have the necessary tools and machinery to undertake your projects efficiently.

Improved Productivity

By providing access to state-of-the-art equipment, this financing option can significantly improve productivity on your construction sites, potentially leading to faster project completion and cost savings.

Construction Line of Credit

Flexibility in Financing

A construction line of credit offers financial flexibility. It functions similarly to a credit card but for your construction project. You can draw funds as needed throughout your project, making it a versatile financing option.

Interest on Amounts Used

Interest is typically only charged on the amount you use, rather than the entire credit line, which can result in cost savings for your project.

SBA Loans for Construction Projects

Support for Small Businesses

Small Business Administration (SBA) loans are designed to support small construction businesses. They offer favorable terms, lower interest rates, and longer repayment periods, making it easier for small construction firms to secure the capital needed for growth.

Government Backing

SBA loans are backed by the government, which means lenders may be more willing to extend financing to small construction businesses with less stringent requirements.

The Loancater Advantage

Why Choose Loancater for Construction Finance?

At Loancater, we’re not just lenders; we’re partners in your construction success. Our experts understand the intricacies of construction finance, and we’re committed to finding the right solution for your unique needs.

Tailored Solutions for Construction Businesses

Every construction project is unique. Loancater offers customized financing options to suit your project’s specific requirements, ensuring you have the right financial tools for success.

Key Considerations for Construction Finance

Assessing Your Construction Project’s Financial Needs Before applying for construction finance, it’s crucial to evaluate your project’s financial requirements accurately. Loancater’s experts can help you determine the right funding amount.

Understanding Interest Rates and Repayment Terms We’ll walk you through the interest rates and repayment terms associated with your financing options, helping you make informed decisions that align with your budget.

The Role of Credit Score in Construction Finance Your credit score can impact your ability to secure financing. Loancater will work with you to find solutions, even if your credit history isn’t perfect.

The Construction Finance Application Process

Preparing Your Construction Business for Financing

We’ll guide you through the preparation process, ensuring you have all the necessary documentation and a solid business plan to support your application.

The Construction Finance Application Timeline

Construction waits for no one. Loancater streamlines the application process to get you the funds you need as quickly as possible.

Common Documentation Requirements

Our experts will outline the documentation you’ll need, which may include your business plan, profit and loss statements, bank statements, and your business credit score.

Construction Finance for Different Project Types

Residential Construction Finance

For builders and developers in the residential sector, Loancater offers tailored financing to bring your housing projects to life.

Commercial Construction Finance

From office complexes to retail spaces, we provide financing options to help your commercial construction projects succeed.

Infrastructure and Public Works Financing

Loancater supports projects that benefit the community, providing the necessary funding for infrastructure and public works initiatives.

Navigating Challenges

Dealing with Budget Overruns

Construction projects often encounter unexpected costs. We’ll help you navigate these challenges to keep your project on track.

Managing Cash Flow During Construction

Cash flow can be a hurdle in construction. Loancater’s financing options are designed to ensure a steady flow of funds when you need them most.

Construction Finance and Risk Mitigation

Insurance and Risk Management Strategies Mitigate risks associated with construction by exploring insurance options and risk management strategies.

Sustainability and Green Construction Financing

The Rise of Sustainable Construction Practices Discover how Loancater supports eco-friendly construction projects by providing financing for sustainable practices.

Financing Green Construction Projects

Explore financing options for projects that prioritize sustainability and environmental responsibility.

In conclusion, construction finance is the cornerstone of successful construction projects, and Loancater is your trusted partner in navigating the complexities of construction finance. With tailored solutions, expert guidance, and a commitment to your success, we’re here to ensure your construction ventures thrive.

Steps to Apply for Construction Finance Ready to take the next step in your construction project? Discover the easy application process with Loancater.