In the ever-evolving landscape of commercial real estate financing, businesses are constantly seeking innovative ways to optimize their financial strategies. One such avenue that has gained prominence is the concept of low doc commercial real estate refinance. This approach offers a simplified and streamlined process for businesses to refinance their commercial properties, leveraging the equity within them to fund expansion, consolidation, and other growth initiatives.

Understanding Low Doc Commercial Real Estate Refinance

Defining Low Documentation Refinance

Low doc commercial real estate refinance is a financing solution designed to cater to businesses that may have limited documentation readily available for a traditional refinance. This approach provides an alternative for self-employed individuals, small business owners, and other entrepreneurs who may not have the extensive paperwork required by conventional lenders.

Benefits of Low Doc Refinance for Commercial Properties

The key advantage of low doc refinance lies in its streamlined application process. Traditional refinancing often demands a plethora of financial documentation, including tax returns, income statements, and credit history. Low doc refinance simplifies this process, making it accessible to a wider range of business owners with varying financial profiles.

Eligibility Criteria for Low Doc Refinance

While the criteria may vary between lenders, low doc refinance options generally require the following:

- Minimum credit score

- Proof of ownership of the commercial property

- Demonstration of property’s equity

- Limited documentation of financials

The Application Process

Simplified Documentation Requirements

Low doc refinance alleviates the need for an extensive collection of financial documents. Instead, lenders typically require:

- Self-certified income declaration

- Property valuation

- Credit history

Working with Specialized Lenders

Choosing a lender experienced in low doc refinancing is crucial. These lenders are well-versed in evaluating applications based on limited documentation and can guide applicants through the process efficiently.

Streamlined Approval Process

The approval process for low doc refinance is often quicker compared to traditional refinance. Lenders focus on property equity and the applicant’s ability to make repayments.

Exploring Refinance Options

Fixed Rate vs. Variable Rate Refinance

Low doc refinance offers both fixed and variable rate options. Businesses can choose based on their risk tolerance and long-term financial goals.

Cash-Out Refinance for Business Expansion

Cash-out refinance allows businesses to leverage the equity in their property to fund expansion, renovations, or other growth initiatives.

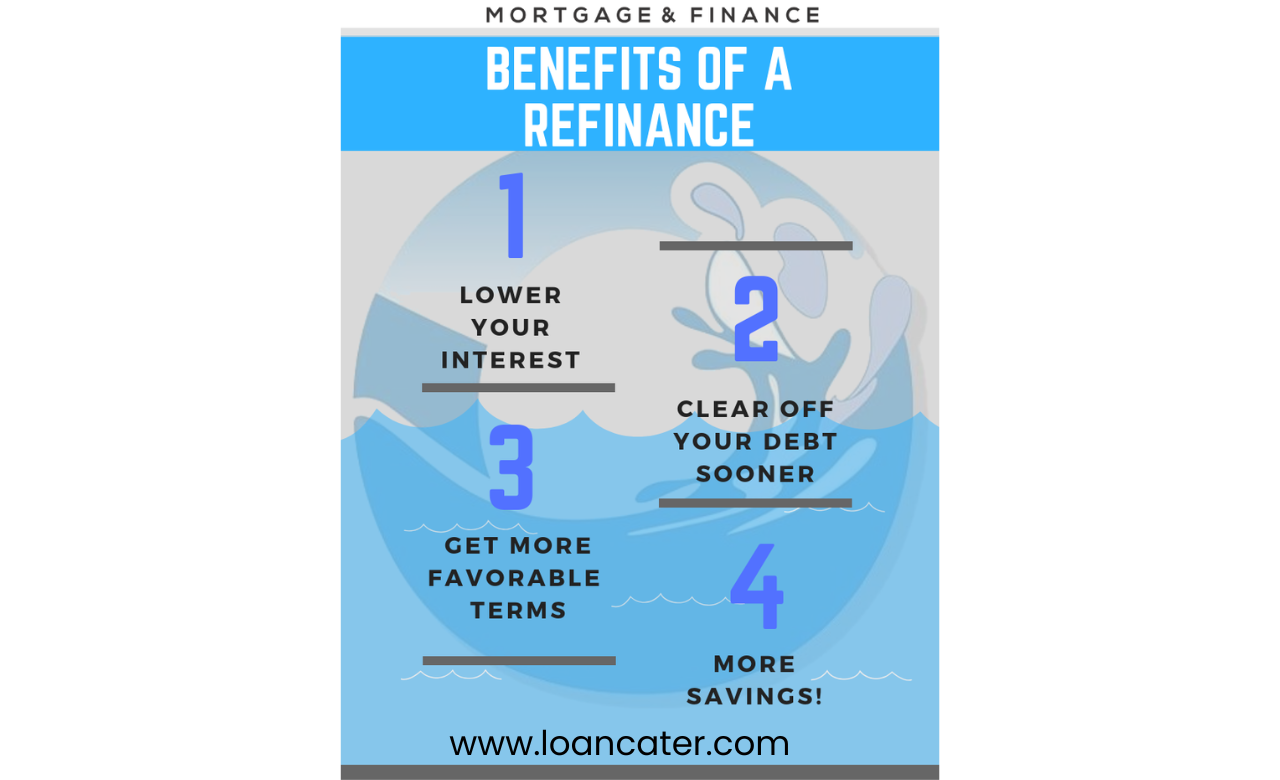

Debt Consolidation through Low Doc Refinance

Businesses burdened by multiple debts can use low doc refinance to consolidate them into a single, more manageable loan.

Calculating Savings and ROI

Assessing Potential Savings through Refinancing

Businesses should evaluate the potential savings from refinancing, including lower interest rates and reduced monthly payments.

Factoring in Closing Costs and Fees

While low doc refinance may have fewer documentation fees, businesses should consider closing costs and compare them to potential savings.

Evaluating Return on Investment

Analyzing the return on investment (ROI) of refinancing is essential to ensure that the benefits outweigh the costs over the loan term.

Navigating the Low Doc Refinance Landscape

Comparing Low Doc Refinance with Traditional Refinance

Low doc refinance offers a more accessible option for businesses with limited documentation, making it a viable alternative to traditional refinancing.

Addressing Concerns about Documentation

Business owners concerned about their limited financial documentation can find relief in low doc refinance solutions.

Tips for a Smooth Low Doc Refinance Application

Prepare a clear self-certified income declaration, ensure accurate property valuation, and work with a lender experienced in low doc financing.

Case Studies: Real-Life Success Stories

Small Business Expanding with Low Doc Refinance

A small business used low doc refinance to access property equity and fund the expansion of their existing location.

Commercial Real Estate Portfolio Enhancement

A property developer leveraged low doc refinance to improve their commercial real estate portfolio, unlocking growth opportunities.

Revitalizing Cash Flow through Refinancing

A struggling business used low doc refinance to consolidate debt, lower interest rates, and improve cash flow.

Benefits of Low Doc Commercial Real Estate Refinance

Flexibility for Self-Employed Individuals

Low doc refinance offers self-employed individuals a viable avenue for refinancing, even without traditional income documentation.

Streamlined Process for Time-Sensitive Needs

The simplified application and approval process of low doc refinance make it an ideal solution for businesses with urgent financial needs.

Unlocking Property Equity for Growth

Low doc refinance empowers businesses to tap into the equity of their commercial properties, providing a funding source for expansion.

Responsible Refinancing Strategies

Assessing Long-Term Financial Goals

Businesses should consider how refinancing aligns with their broader financial objectives and growth plans.

Creating a Repayment Plan

Mapping out a repayment plan ensures businesses can comfortably meet their loan obligations and maintain financial stability.

Maximizing the Benefits of Refinancing

Utilizing the funds from low doc refinance strategically can amplify business growth and long-term financial health.

Factors Impacting Refinance Terms

Property Value and Appraisal

The property’s current value and a thorough appraisal influence the loan amount and terms.

Business Financial Health

Lenders assess the business’s financial stability and capacity to repay the loan.

Market Conditions and Interest Rates

Market trends and interest rates play a role in determining the terms and rates of low doc refinance.

Post-Refinance Considerations

Managing the New Loan Structure

Businesses should adjust their financial management to accommodate the new loan structure and repayment schedule.

Monitoring Cash Flow and ROI

Regularly evaluating cash flow and ROI helps businesses ensure that refinancing continues to provide value.

Leveraging Equity for Future Endeavors

The equity unlocked through low doc refinance can serve as a valuable resource for future growth initiatives.

Common Misconceptions about Low Doc Refinance

Myth: High-Interest Rates for Low Doc Loans

Low doc refinance rates can be competitive, especially when the property has substantial equity.

Myth: Limited Eligibility for Low Doc Refinance

Businesses with diverse financial profiles can qualify for low doc refinance, offering greater accessibility.

Debunking Misunderstandings about Low Doc Financing

Addressing misconceptions helps businesses make informed decisions about low doc refinance.

FAQs

What documents are typically required for low doc refinance?

Low doc refinance generally requires a self-certified income declaration, property valuation, and credit history.

How does low doc refinance affect my credit score?

Low doc refinance, like any loan, can impact your credit score based on timely repayments.

Can I refinance multiple commercial properties with low doc solutions?

Yes, multiple commercial properties can be refinanced using low doc solutions, subject to lender criteria.

What’s the typical loan term for low doc commercial real estate refinance?

Loan terms for low doc refinance can vary but typically range from 5 to 20 years.

Is low doc refinance suitable for startups?

Low doc refinance can be suitable for startups that own commercial properties and have equity.

Conclusion

In a world where access to funding is vital for business growth, low doc commercial real estate refinance emerges as a dynamic solution. Offering accessibility, streamlined processes, and valuable benefits, this financing option empowers businesses to leverage their property equity and drive expansion. By exploring the nuances, benefits, and considerations of low doc refinance, businesses can chart a path toward sustainable growth and financial prosperity.