Roofing services play a crucial role in the construction industry, ensuring that buildings are well-protected from the elements. Whether it’s residential, commercial, or industrial roofing, the demand for skilled roofing contractors is always present. However, running a successful roofing service business requires more than just expertise in the craft. It also demands financial stability and access to necessary resources. This guide aims to help roofing service owners in the USA understand and secure construction business loans tailored to their specific needs.

Understanding Construction Business Loans

The construction sector relies heavily on financial support to thrive. From purchasing equipment and materials to managing overhead costs, the financial demands of a roofing service business can be significant. Construction business loans are designed to address these needs, offering financing solutions that enable roofing contractors to expand their operations, upgrade equipment, and invest in growth.

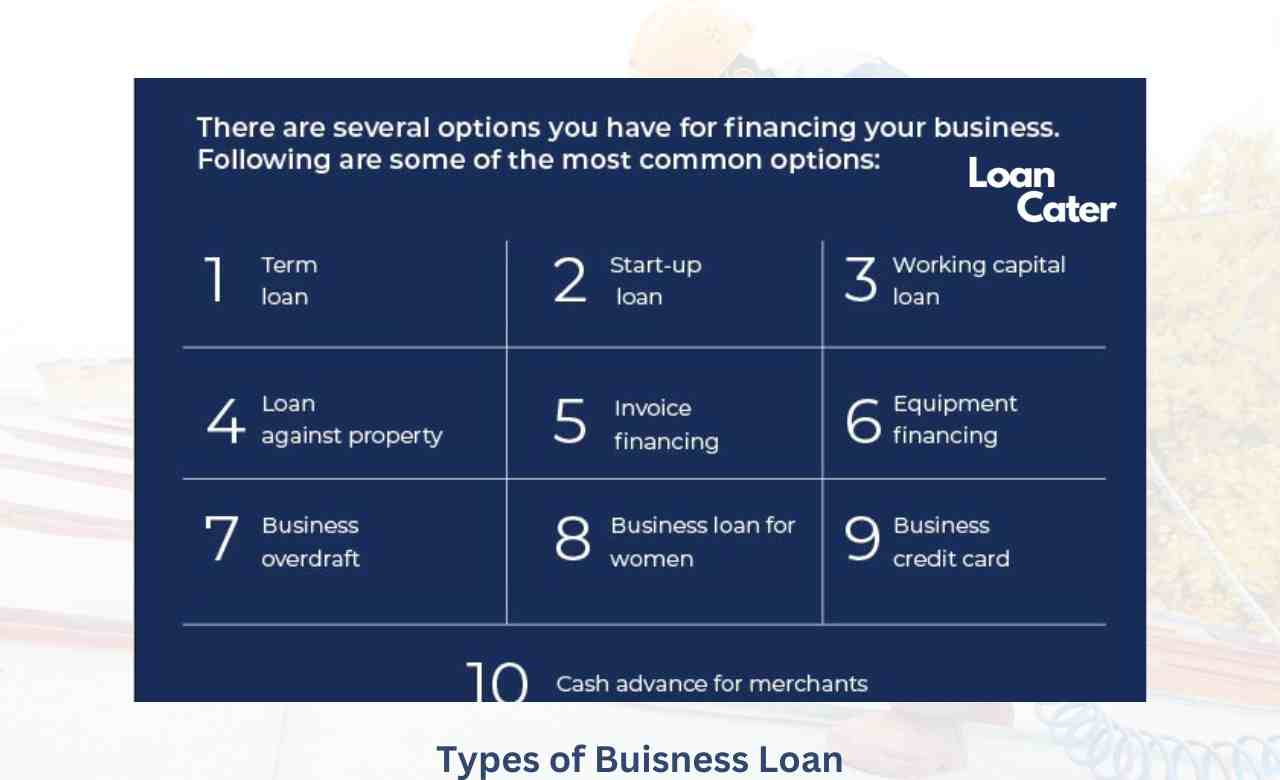

Types of Construction Business Loans

Traditional Bank Loans:

Conventional loans from banks are a standard option. They provide lump-sum funding for roofing businesses with manageable interest rates and terms.

SBA Loans for Roofing Service Businesses:

Small Business Administration (SBA) loans offer favorable terms and lower down payments, making them suitable for roofing services looking to expand.

Equipment Financing for Roofing Services:

Roofing equipment is expensive. Equipment financing loans help roofing contractors acquire or upgrade essential tools without draining their cash flow.

Line of Credit for Roofing Contractors:

A revolving credit line provides roofing businesses with ongoing access to funds. This is particularly useful for managing unpredictable expenses.

Invoice Financing for Roofing Projects:

Invoice financing allows roofing contractors to receive advances on outstanding invoices, ensuring consistent cash flow for ongoing projects.

Qualifying for Construction Business Loans

- Credit Score and Financial Health: Lenders often consider the credit score of the business and its owners. A healthy credit history increases the chances of approval.

- Business Plan and Revenue Projections: Demonstrating a well-thought-out business plan and projected revenue streams showcases the viability of the roofing service.

- Collateral and Guarantees: Some loans require collateral, which is an asset that the lender can claim if the loan isn’t repaid. Guarantees from business owners may also be necessary.

Finding the Right Lender

Research is crucial when choosing a lender. Look for institutions experienced in providing loans to roofing service businesses. Online lenders specializing in construction loans can offer convenience and tailored solutions. Working with lenders familiar with the roofing industry can expedite the application process.

Application Process

Gathering the necessary documentation is a crucial step. This includes financial statements, tax returns, and business plans. Online applications are often more streamlined, allowing for quicker responses. Accuracy in providing information is vital to ensure the loan process goes smoothly.

Loan Amounts and Terms

Determining the loan amount depends on the specific needs of the roofing service. Careful consideration should be given to ensure that the loan amount is sufficient without straining the business’s ability to repay. Negotiating favorable loan terms, such as interest rates and repayment periods, is key to managing costs.

Interest Rates and Fees

Interest rates can vary based on credit history and loan type. It’s essential to understand the terms and conditions related to interest rates and any additional fees or charges associated with the loan.

Utilizing Loan Funds

Construction loans for roofing services can be used for various purposes:

- Investment in Roofing Equipment and Tools: Upgrading or acquiring new equipment can enhance the quality and efficiency of roofing projects.

- Expanding Service Offerings: The loan can facilitate the expansion of services offered, attracting a broader range of clients.

- Hiring and Training Skilled Roofing Professionals: Funds can be allocated to hiring and training skilled staff to ensure the roofing service’s excellence.

Case Studies

Real-life case studies highlight how construction business loans have propelled roofing service businesses to success. These examples provide insights into how funds were utilized and the positive outcomes achieved.

Benefits of Construction Business Loans for Roofing Services

Construction loans offer numerous advantages:

- Accelerating Business Growth and Expansion: With access to funds, roofing services can take on more projects and expand their customer base.

- Providing High-Quality Roofing Solutions: Upgrading equipment and tools improves workmanship and customer satisfaction.

- Building a Strong Reputation in the Industry: Successful projects funded by loans contribute to a roofing service’s reputation for excellence.

Risks and Challenges

Business owners should be aware of the responsibilities that come with loans. Managing debt responsibly is crucial, as defaulting on payments can have severe consequences. Market fluctuations and economic factors can also impact the roofing industry, affecting the ability to repay loans.

Summary

Construction business loans provide essential financial support for roofing service owners in the USA. These loans are tailored to the specific needs of the industry, offering roofing contractors the means to invest in growth, deliver exceptional services, and establish themselves as reputable players in the construction sector.

Frequently Asked Questions (FAQs)

Q: What types of loans are available for roofing service businesses?

A: Roofing service businesses have access to various types of loans tailored to their needs. These include traditional bank loans, SBA loans, equipment financing, lines of credit, and invoice financing. Each type has its benefits and considerations, allowing roofing contractors to choose the option that best suits their requirements.

Q: How can I improve my chances of qualifying for a construction business loan?

A: Improving your chances of qualifying for a construction business loan involves several steps. First, ensure that your credit score is healthy and demonstrate a solid financial history. Provide a well-structured business plan with revenue projections to showcase the viability of your roofing service. Offering collateral or guarantees can also boost your eligibility. Working with lenders experienced in construction loans can further enhance your chances.

Q: Can I use a construction loan to hire additional staff?

A: Yes, construction loans can be used to hire and train additional staff for your roofing service business. Expanding your workforce with skilled professionals can contribute to improved project quality, increased efficiency, and the ability to take on more projects. However, it’s essential to factor in staffing costs when determining the loan amount to ensure responsible borrowing.

Q: What factors determine the interest rates for roofing service business loans?

A: Interest rates for roofing service business loans are influenced by various factors. These include your credit history, the type of loan, the lender’s terms, and prevailing market conditions. Lenders assess the risk associated with lending to your business, and a strong credit history can lead to more favorable interest rates.

Q: How long does the loan approval process typically take?

A: The loan approval process duration can vary depending on the lender and the type of loan. Generally, online lenders offer faster application processing compared to traditional banks. Some loans, such as lines of credit or invoice financing, may have quicker approval times due to their streamlined nature. It’s recommended to inquire with potential lenders about their estimated approval timelines.

Conclusion

Empower your roofing service business with the financial resources it needs to thrive. Construction business loans offer tailored solutions that enable roofing contractors to achieve their growth and expansion goals while delivering high-quality services to clients.