In today’s fast-paced world, financial emergencies can strike when least expected. When you’re faced with urgent expenses, a $255 payday loan online, available on the same day, can provide swift relief. This comprehensive guide delves into the specifics of these short-term loans, covering their benefits, application process, risks, and responsible borrowing practices.

Benefits of $255 Payday Loans: Speed and Convenience

$255 payday loans offer a lifeline for immediate financial needs. With a straightforward application process, borrowers can access funds within a short span, making them a practical solution for unexpected expenses. Moreover, these loans often require minimal credit checks, allowing individuals with varying credit scores to apply.

Applying for $255 Payday Loans: Fast Approvals

The application process for $255 payday loans is streamlined, and primarily conducted online. Borrowers fill out a simple form, provide necessary documentation, and await approval. Many lenders offer same-day approvals, ensuring that funds are transferred to the borrower’s bank account promptly.

Eligibility Criteria and Documentation

To qualify for a $255 payday loan, applicants typically need to meet age and legal requirements, provide proof of income or employment, and have an active bank account. Meeting these criteria ensures a smoother borrowing experience.

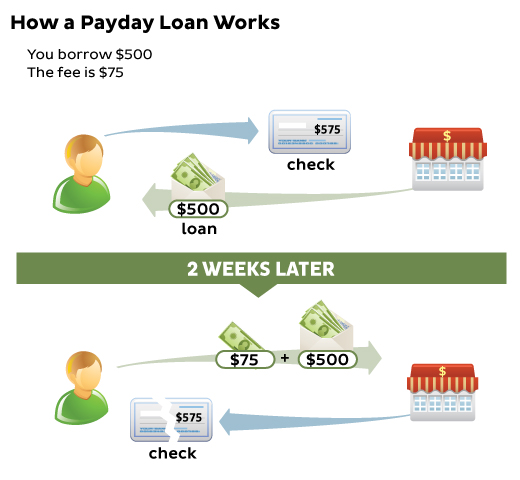

Understanding Interest Rates and Fees

While $255 payday loans offer quick access to funds, it’s essential to grasp the associated costs. Interest rates are expressed as Annual Percentage Rates (APRs), reflecting the total cost of borrowing. State regulations influence fee structures, and borrowers should carefully review the terms before proceeding.

Responsible Repayment and Avoiding Debt Cycles

Timely repayment is crucial to avoid falling into a debt cycle. Borrowers should choose a repayment schedule that aligns with their financial situation and ensures they can meet their obligations on time. Rollovers or extensions may lead to additional fees and complicate financial matters.

Alternatives and Considerations

Before pursuing a $255 payday loan, explore alternative options. Traditional personal loans from banks, credit card cash advances, and borrowing from friends or family can offer more favorable terms. It’s essential to weigh the urgency of your financial need against the costs of borrowing.

Choosing Reputable Lenders

When seeking financial assistance, it’s crucial to select lenders that prioritize your best interests. Consider the following steps to ensure you’re working with reputable lenders:

Researching Lender Credibility and Reviews

Take the time to research lenders thoroughly. Look for well-established institutions with a history of responsible lending. Reading customer reviews and testimonials can provide insights into other borrowers’ experiences, helping you gauge a lender’s reputation.

Identifying Potential Scams and Fraudulent Lenders

Be cautious of red flags that may indicate potential scams or fraudulent lending practices. Watch out for lenders that demand upfront fees or pressure you to commit hastily. Verify the lender’s contact information and ensure a legitimate online presence.

Transparency in Terms and Conditions

Transparent terms and conditions are essential for a positive borrowing experience. Protect yourself by understanding the terms of the loan agreement:

Reading and Understanding Loan Agreements

Carefully read the loan agreement, including all terms and conditions. If anything is unclear, don’t hesitate to ask the lender for clarification. Ensure you understand the repayment schedule, interest rates, fees, and any potential penalties.

Avoiding Hidden Fees and Unexpected Charges

Hidden fees can catch borrowers off guard. Scrutinize the loan agreement for any mention of hidden or additional charges. Reputable lenders provide transparent information about all associated costs, enabling you to make an informed borrowing decision.

By prioritizing lender credibility, researching reviews, and ensuring transparency, you can safeguard your financial well-being while navigating the borrowing process.

Impact on Credit Scores and Financial Wellness

Timely repayment of payday loans may not significantly impact credit scores, but missed payments can indirectly affect creditworthiness. Borrowers should consider how borrowing aligns with their overall financial wellness goals.

FAQs about $255 Payday Loans Online Same Day

- How quickly can I get the funds from a $255 payday loan online?

With many lenders offering same-day approvals, you can often access the funds within hours of application approval. The swift process makes $255 payday loans a practical solution for urgent financial needs.

- What if I can’t repay the $255 loan on the due date?

If you find it challenging to repay the loan on the agreed-upon due date, contact your lender immediately. Some lenders may offer options for extensions or repayment plans. However, it’s crucial to understand any associated fees or implications.

- Can I extend or roll over the $255 payday loan?

Some lenders may allow loan extensions or rollovers, but this often involves additional fees. It’s advisable to explore this option only when you’re certain that you’ll be able to repay the loan under the new terms to avoid further financial strain.

- Are same-day approvals guaranteed for $255 payday loans?

While many lenders aim to provide same-day approvals, approval times can vary based on factors such as the lender’s policies, your application accuracy, and the time of day you apply. It’s best to check with the lender for their specific approval timelines.

- Can I qualify for a $255 payday loan with bad credit?

Yes, one of the advantages of $255 payday loans is that they often have minimal credit requirements. Lenders typically consider your ability to repay the loan rather than solely relying on your credit history. However, each lender’s criteria may vary.

- Are $255 payday loans regulated by state laws?

Yes, payday loans are subject to state-specific regulations that govern interest rates, fees, and borrower protections. It’s essential to familiarize yourself with your state’s rules to understand your rights and the terms of the loan.

- What documents do I need to provide for a $255 payday loan?

While the exact documentation required can vary among lenders, you’ll generally need to provide proof of identity, income or employment, and an active bank account. Some lenders may request additional documentation for verification.

- Can I get multiple $255 payday loans simultaneously?

Lenders often have policies in place to prevent borrowers from taking out multiple loans at once. It’s crucial to inquire with your chosen lender about their specific policies regarding multiple loans.

- Are $255 payday loans suitable for long-term financial needs?

$255 payday loans are designed for short-term, immediate financial needs. They’re not intended to address long-term economic challenges. It’s essential to consider alternatives and assess your ability to repay within the specified timeframe.

- How can I ensure responsible borrowing with $255 payday loans?

Responsible borrowing entails assessing your financial situation, understanding the terms and fees, exploring alternatives, and ensuring timely repayment. It’s also advisable to borrow only what you genuinely need to avoid unnecessary debt.

Conclusion: Using $255 Payday Loans Wisely

In times of urgent financial need, $255 payday loans can provide a quick solution. However, borrowers should approach these loans responsibly, understanding their terms, considering alternatives, and ensuring timely repayment.